1. Yintoni i-Stochastic RSI?

Ukuqonda iStochastic RSI Dynamics

I-Stochastic RSI (i-StochRSI) isebenza kumgaqo othi kwi- imarike bullish, amaxabiso aya kuvala asondele phezulu, kwaye ngexesha a kwimarike bearish, amaxabiso adla ngokuvala kufutshane nokusezantsi kwawo. Ukubalwa kwe-StochRSI kubandakanya ukuthatha i-RSI ye-asethi kunye nokusebenzisa ifomula ye-Stochastic, ethi:

StochRSI = (RSI - Lowest Low RSI) / (Highest High RSI - Lowest Low RSI)

Iiparamitha eziphambili zeStochRSI:

- RSI: The Relative Index Ukomelela ilinganisa ubungakanani botshintsho lwamva nje lwamaxabiso ukuvavanya iimeko ezithengiswe kakhulu okanye ezithengiswe ngokugqithisileyo.

- Elona RSI liPhantsi: Elona xabiso liphantsi le-RSI kwixesha lokujonga emva.

- Eyona RSI iPhezulu: Elona xabiso liphezulu le-RSI kwixesha lokujonga emva.

Ukutolika Iimpawu zeStochRSI

- Umhlaba othengiwe ngokugqithisileyo: Xa i-StochRSI ingaphezulu kwe-0.8, i-asethi ithathwa njengethengi kakhulu. Iphakamisa ukuba ixabiso linokuba ngenxa yokutsalwa okanye ukubuyisela umva.

- Ummandla othengisiweyo: Xa i-StochRSI ingaphantsi kwe-0.2, i-asethi ithathwa njengento ethengiswa kakhulu. Oku kubonisa amandla okunyuka kwexabiso okanye ukuguqulwa.

Ukuphucula iiSetingi zeStochRSI

Traders bahlala behlengahlengisa useto lweStochRSI ukuze luhambelane nesicwangciso sabo sokurhweba:

- Ixesha lelixa: Ukusetwa okusemgangathweni yi-14-period StochRSI, kodwa oku kunokufinyezwa kubuntununtunu obungaphezulu okanye kwandiswe ngeempawu ezimbalwa, kodwa ezithembekileyo.

- Ukugudisa: Ukufaka isicelo umlinganiselo ohambayo, njengeentsuku ezi-3 umlinganiselo olula wokuhamba, inokunceda ukugudisa iStochRSI kunye nokuhluza ingxolo.

Ukudibanisa iStochRSI kunye nezinye izalathisi

Ukunciphisa i ingozi yemiqondiso yobuxoki, traders inokudibanisa iStochRSI kunye nezinye izikhombisi:

- Imilinganiselo yokuHamba: Inokunceda ukuqinisekisa intsingiselo yendlela.

- MACD: The Ukuhambisa umndilili wokuDibana kokungafani inokubonelela ngesiqinisekiso esongezelelweyo kwi ngesantya kunye nentsingiselo.

- Bollinger Ibhendi: Xa isetyenziswa kunye ne-StochRSI, inokunceda ekuchongeni ukuguquguquka kwexabiso kunye nokuqhambuka kwexabiso.

Iingcebiso ezisebenzayo ze Traders Ukusebenzisa iStochRSI

- Khangela iiDivergences: Ukuba ixabiso lenza into entsha ephezulu okanye ephantsi engakhange ibonakaliswe yi-StochRSI, ingabonisa umkhwa obuthathaka kunye nokuguqulwa okunokwenzeka.

- StochRSI Crossovers: I-crossover ye-StochRSI ngaphezu kwe-0.8 okanye i-0.2 yezinga ingabonakalisa ukuthenga okanye ukuthengisa ithuba, ngokulandelanayo.

- Ukusetyenziswa kwiiMeko zeMarike ezahlukeneyo: I-StochRSI inokusebenza kuzo zombini iimarike ezihamba phambili kunye noluhlu, kodwa kubalulekile ukulungisa indlela ngokufanelekileyo.

I-StochRSI-Isixhobo sokuGcinwa kwexesha leMarike

IStochRSI yongeza a tradeUkukwazi kwe-r ixesha lokungena kwimarike kunye nokuphuma ngokugxila kwisantya kunye nokutshintsha kweentshukumo zexabiso. Uvakalelo lwayo luyenza ibe sisixhobo esibalulekileyo kwabo bafuna ukuphendula ngokukhawuleza kwiinguqu zemarike. Nangona kunjalo, amathuba okuba imiqondiso yobuxoki ifuna ukusetyenziswa koqinisekiso olongezelelweyo oluvela kwabanye uhlalutyo yobugcisa iindlela zokuqinisekisa imiqondiso ebonelelwa yiStochRSI.

2. Indlela yokuSeta i-Stochastic RSI kwi-Platform yakho yokuRhweba?

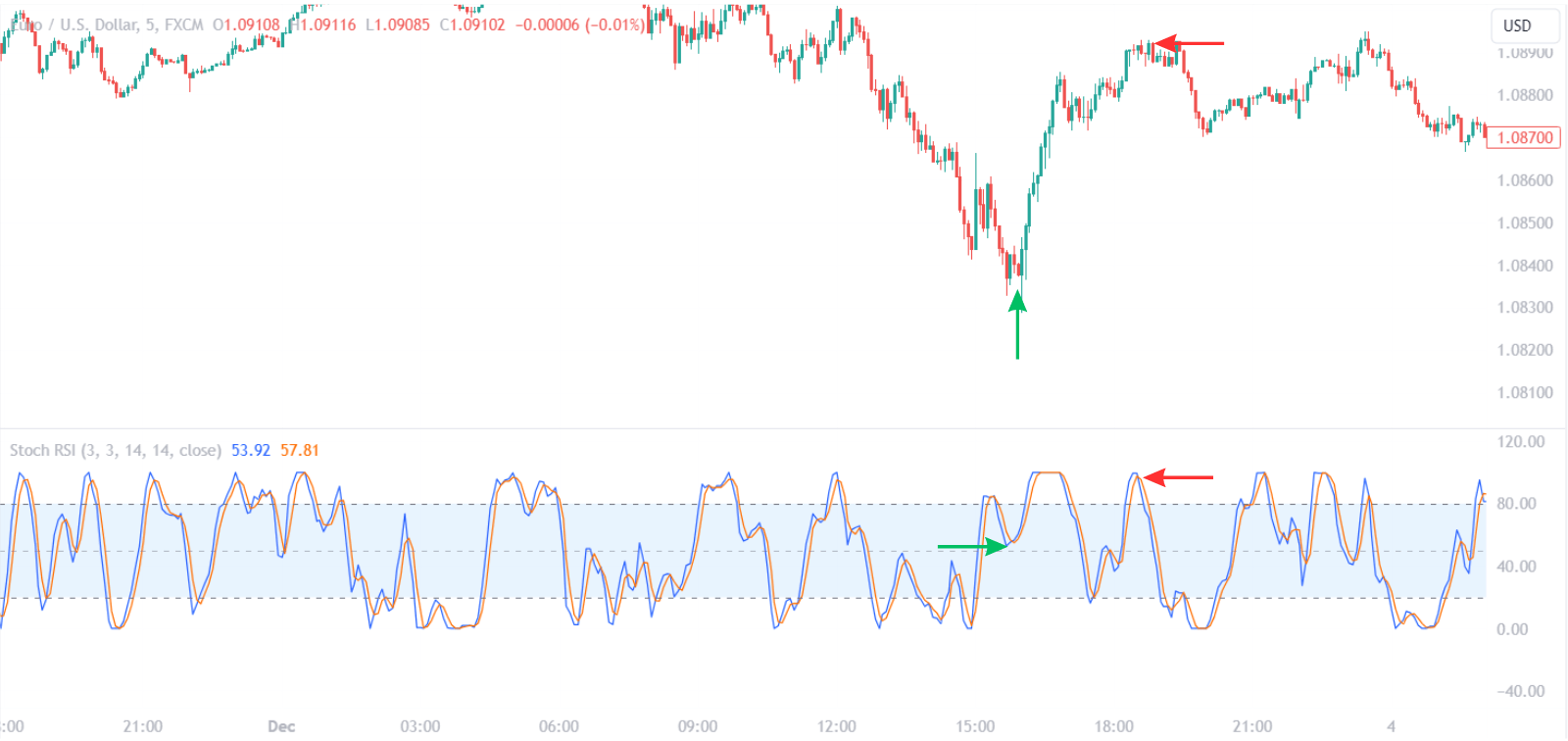

Xa uqwalasela I-Stochastic RSI, traders kufuneka izazi iinxalenye zayo ezimbini eziphambili: i Umgca we-%K kwaye i Umgca we-%D. Umgca we-% K lelona xabiso le-RSI yestochastic, ngelixa umgca we-%D ngumndilili ohambahambayo womgca we-%K, usebenza njengomgca womqondiso. Inkqubo eqhelekileyo kukuseta umgca we-%D ku-a I-3-ixesha elihambayo eliphakathi yomgca we-%K.

Ukutolika iStochastic RSI ibandakanya ukukhangela ukuthenga ngokugqithisileyo kunye neemeko ezithengiswa kakhulu. Ngokuqhelekileyo, amaxabiso angentla 0.80 bonisa iimeko ezithengwe ngokugqithisileyo, ecebisa uphawu olunokubakho lwentengiso, kanti amaxabiso angezantsi 0.20 bonisa iimeko ezithengiswe ngokugqithisileyo, ubonise uphawu lokuthenga olunokwenzeka. Nangona kunjalo, traders kufuneka balumke kwaye bajonge isiqinisekiso kwezinye izalathisi okanye iipateni zexabiso ukunqanda imiqondiso yobuxoki.

Ukuchithwa yenye ingcamango ebalulekileyo xa usebenzisa i-Stochastic RSI. Ukuba ixabiso lenza ukuphakama okutsha ngelixa i-Stochastic RSI ihluleka ukwenza njalo, yaziwa ngokuba yi-a ukuhlukana komoya kwaye ingabonisa uguquko olunokubakho ukuya kwicala elisezantsi. Ngokuchaseneyo, a ukuhlukana kwe-bullish kwenzeka xa ixabiso lenza ukuhla okutsha, kodwa iStochastic RSI ayikho, ibonisa ukunyuka okunokwenzeka.

Mqaqamlezo phakathi komgca we-%K kunye nomgca we-%D nazo zibalulekile. Umnqamlezo ongentla komgca we-%D unokubonwa njengophawu lwe-bullish, ngelixa umnqamlezo ongezantsi unokuqwalaselwa njenge-bearish. Nangona kunjalo, kubalulekile ukuqinisekisa ukuba le minqamlezo iyenzeka ngokubambisana nezinye izinto, ezifana nenkxaso kunye namanqanaba okumelana, ukwandisa ukuthembeka kwabo.

| Stochastic RSI Component | inkcazelo |

|---|---|

| Umgca we-%K | Imele elona xabiso leStochastic RSI |

| Umgca we-%D | Umndilili ohambahambayo womgca we-%K, uhlala usetyenziswa njengomgca wophawu |

| iNqanaba lokuThengiswa ngokugqithisileyo | Ngokuqhelekileyo ibekwe kwi-0.80, ingabonisa ithuba lokuthengisa |

| iNqanaba eliThengisiweyo | Ngokuqhelekileyo ibekwe kwi-0.20, ingabonisa ithuba lokuthenga |

| Ukuchithwa | Umahluko phakathi kwesenzo sexabiso kunye ne-Stochastic RSI, ebonisa ukuguqulwa okunokwenzeka |

| Mqaqamlezo | Umgca we-%K owela ngaphaya okanye ngaphantsi komgca we-%D, ubonelela ngeempawu ze-bullish okanye ze-bearish |

Ukuxokomezela analysis action ixabiso, njengeepateni zekhandlela kunye nenkxaso / amanqanaba okumelana, kunye nokufundwa kwe-Stochastic RSI kunokuphucula trade ukuchaneka. Umzekelo, ipateni yokuntywila ye-bullish kwinqanaba elithengisiweyo kwi-Stochastic RSI inokuba luphawu olunamandla lokuthenga. Ngokufanayo, ipateni yokudubula ye-bearish kwinqanaba eligqithisiweyo linokuba ngumqondiso oqinileyo wokuthengisa.

Ulawulo lwengozi kufuneka ihlale ihamba kunye nokusetyenziswa kwezalathi zobugcisa. Ukumisela imiyalelo yelahleko yokuyeka kumanqanaba acwangcisiweyo kunye nokumisela ubungakanani obufanelekileyo bendawo kunokuncedisa ukulawula ilahleko enokwenzeka. TradeI-rs kufuneka kwakhona iqaphele ukukhutshwa kweendaba zezoqoqosho ezinokubangela ukuguquguquka kunye nefuthe ekusebenzeni kwezalathi zohlalutyo lobugcisa njenge-Stochastic RSI.

Ngokudibanisa i-RSI ye-Stochastic kunye ne-comprehensive cwangciso so shishino kunye neendlela ezifanelekileyo zokulawula umngcipheko, tradeI-rs inokujolisa ekuphuculeni ukuchaneka kwamangenelo emarike kunye nokuphuma, okunokukhokelela kwiziphumo zorhwebo ezingaguqukiyo.

2.1. Ukukhetha ixesha elililo

Ukhetho lweXesha leStochastic RSI:

| Trader Uhlobo | Ixesha Elikhethiweyo | Injongo |

|---|---|---|

| Usuku Traders | 1-umzuzu ukuya kwi-15 yemizuzu yeetshathi | Thatha ngokukhawuleza, iintshukumo ze-intraday |

| Ukuguquka Traders | Iyure enye ukuya kwiitshathi zeyure ezi-1 | Ukulinganisa ubuninzi besignali kunye nokuhluzwa kwengxolo yemarike |

| indawo Traders | Iitshathi zemihla ngemihla | Fumana okuthembekileyo isantya kunye nezalathi zokubuyela umva |

UPhumelezo kunye nokuBambisa:

- Lungisa useto lwe-Stochastic RSI ukuhambelana nexesha elikhethiweyo.

- Emuva qhinga usebenzisa idatha yembali.

- Injongo yokulinganisela phakathi ukuchaneka komqondiso kunye nenani le trade Mathuba.

Ngokukhetha ngononophelo kunye nokwandisa ixesha lexesha kunye nezicwangciso ze-RSI ze-Stochastic, traders bangawaphucula amathuba abo okuphumeza ngempumelelo trades ezidityaniswe nomntu wazo izicwangciso zorhwebo kunye namanqanaba okunyamezela umngcipheko. Kubalulekile ukukhumbula ukuba akukho xesha elinye okanye iseti yesalathisi iya kusebenza kubo bonke traders okanye iimeko zemarike, ukwenza ubuqu kunye novavanyo oluqhubekayo amacandelo aphambili esicwangciso sorhwebo esomeleleyo.

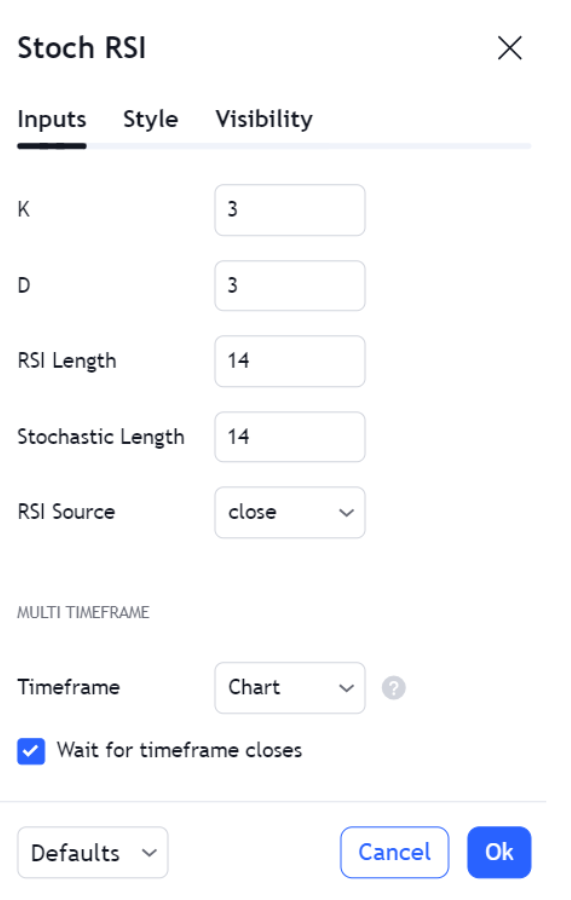

2.2. Ukulungelelanisa iiSetingi zeSalathisi

Xa uqwalasela I-Stochastic RSI ukwenza okona kulungileyo, qwalasela ezi seto zingundoqo:

- Ixesha lokujonga emva: Ukungagqibeki ngamaxesha ali-14, kodwa oku kunokulungiswa malunga novakalelo olungaphezulu okanye olungaphantsi.

- Ugudisa umgca we-%K: Ukutshintsha ixesha lokubala kuchaphazela ukusabela kutshintsho lwemarike.

- I-%D yokugudisa umgca: Lungiselela umndilili oshukumayo womgca we-%K ukuze ulungelelanise uvakalelo lophawu.

- I-Oversold Thresholds: Ngokuqhelekileyo ibekwe kwi-80/20, kodwa ingatshintshwa ibe yi-70/30 okanye i-85/15 ukuze ihambelane neemeko zemarike.

| Icwangcisa | silela | Uhlengahlengiso Lwexesha elifutshane | Uhlengahlengiso Lwexesha Elide |

|---|---|---|---|

| Ixesha lokujonga emva | 14 | 5-9 | 20-25 |

| Ugudisa umgca we-%K | 3 | Nciphisa ukuphendula ngokukhawuleza | Yandisa impendulo egudileyo |

| I-%D yokugudisa umgca | 3 | Nciphisa ukuphendula ngokukhawuleza | Yandisa impendulo egudileyo |

| I-Overbought Threshold | 80 | 70 okanye 85 | 70 okanye 85 |

| I-Oversold Threshold | 20 | 30 okanye 15 | 30 okanye 15 |

Ukubuya kwakhona linyathelo elingaxoxisiyo kwinkqubo yohlengahlengiso. Iqinisekisa ukusebenza koseto olutsha kwaye ilungelelanise ne trader iqhinga. Olu hlaziyo lwembali lunciphisa umngcipheko wokwamkela useto olungasebenziyo kunye nokwandisa ukuzithemba kokuthatha izigqibo.

Traders kufuneka bakhumbule ukuba akukho setingi enye evumelana nazo zonke iimeko zemarike. Uvavanyo oluqhubekayo kunye nohlengahlengiso lweeparamitha ze-Stochastic RSI zibalulekile ukugcina ukufaneleka kunye nokuchaneka kweempawu ezibonelela ngazo. Injongo kukufumana ukulingana phakathi kokuphendula kwiintshukumo zeemarike kunye nokunciphisa izibonakaliso zobuxoki, ezilungiselelwe trader indlela ethile kunye nokusingqongileyo kwimarike.

2.3. Ukudibanisa neZixhobo zokuTshatha

Ukugxininisa indima yeZalathi zoMqulu

Ukuxokomezela izalathisi zevolumu ecaleni kwe-Stochastic RSI inokomeleza kakhulu ukuthembeka kweempawu ozifumanayo. Iimpawu zeVolume ezifana ne-On-Balance Volume (OBV) okanye i-Volume-weighted Average Price (VWAP) inokuqinisekisa umfutho ofunyenwe yi-Stochastic RSI. Ukunyuka kwevolumu ngexesha le-bullish ye-Stochastic ye-RSI isignali inokuqinisekisa inzala yokuthenga, ngelixa ivolumu ekhulayo ngexesha le-bearish signal inokuphakamisa uxinzelelo olunamandla lokuthengisa.

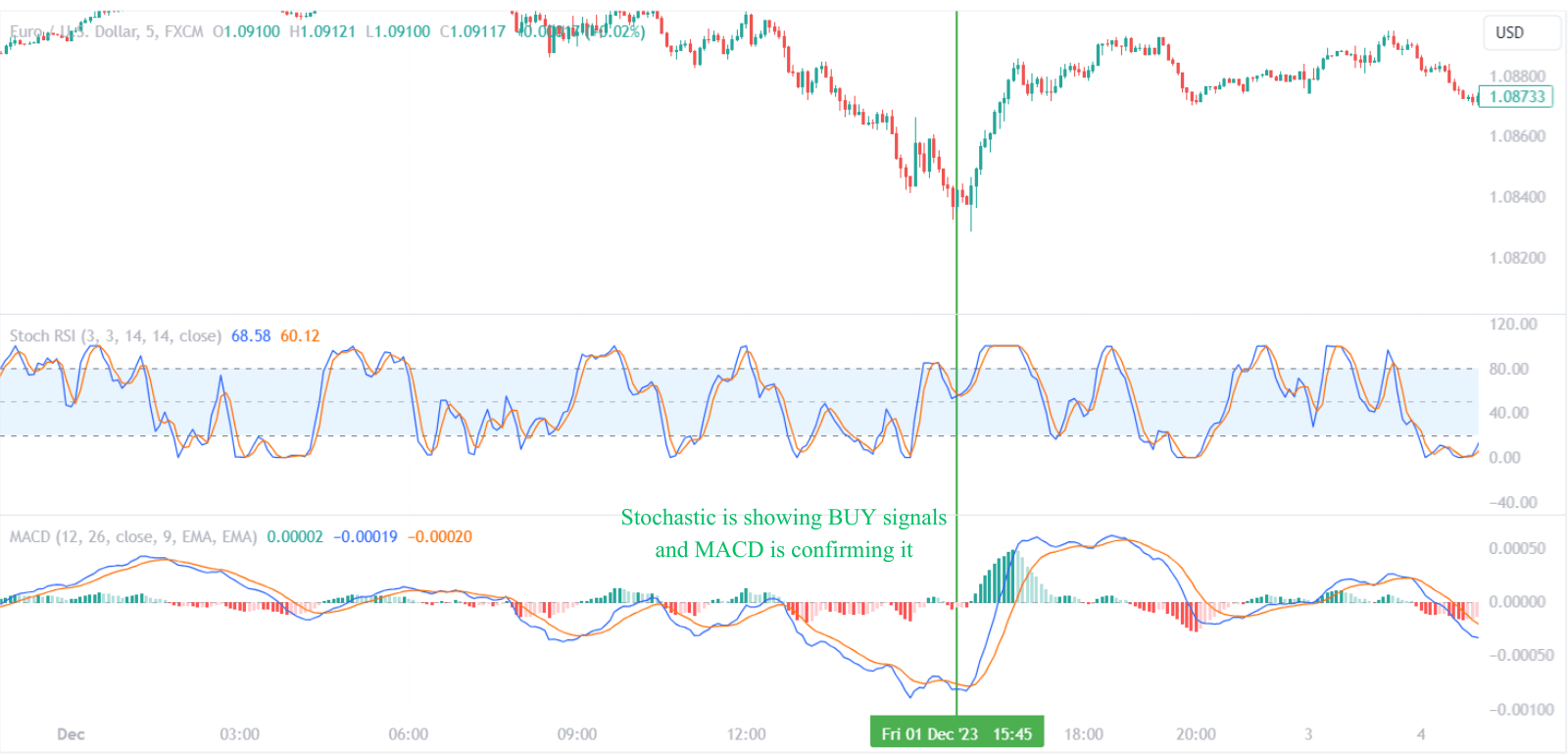

Ukudibanisa neeOscillators zoQinisekiso lweMomentum

omnye ii-oscillators, njenge-MACD (i-Moving Average Convergence Divergence) okanye i-RSI (i-Relative Strength Index), xa isetyenziswe kwi-tandem kunye ne-Stochastic RSI, inokubonelela ngesiqinisekiso esongezelelweyo sokunyuka. I-crossover ye-bullish kwi-MACD okanye ukunyuka ngaphezu kwe-50 kwi-RSI inokuqinisa uphawu lokuthenga kwi-Stochastic RSI.

| Stochastic RSI Umqondiso | Isalathisi esiqinisekisayo | Intshukumo enokwenzeka |

|---|---|---|

| Ngaphezulu | Bearish MACD Crossover | Cinga ngokuthengisa |

| Ngaphezulu | Bullish MACD Crossover | Cinga ngokuThenga |

| cala | RSI malunga nama-50 | Bamba/Lindela uQinisekiso |

Ukusetyenziswa ngobuchule kweepateni zekhandlela

Iipateni zeekhandlela inokusebenza njengoncedo olubonakalayo olunamandla kuhlalutyo lwe-Stochastic RSI. Iipateni ezinje ngekhandlela eligqumayo, ihamile, okanye inkwenkwezi edubulayo zinokunika ukuqonda kwangoko kwintengiso. Ipateni yokugubungela i-bullish kufutshane nenqanaba le-Stochastic RSI eligqithisiweyo linokuba luphawu olunamandla lokuthenga, ngelixa inkwenkwezi edubulayo kwinqanaba eligqithisiweyo linokubonisa ithuba lokuthengisa elinokubakho.

Ngokudibanisa i-RSI ye-Stochastic kunye nezixhobo ezahlukeneyo zokutshaja kunye nezalathi zobugcisa, traders inokudala isikhokelo sohlahlelo olubanzi noluguquguqukayo. Oku kudityaniswa akugcini nje ukwandisa amandla okuqikelelwa kwe-Stochastic RSI kodwa ikwavumela ukuqonda okuthe kratya kokuguquguquka kweemarike, okukhokelela kwizigqibo ezicwangcisiweyo nezinolwazi lokurhweba.

3. Indlela yokusebenzisa i-Stochastic RSI kwi Trade Iimpawu?

Xa usebenzisa i I-Stochastic RSI, traders kufuneka ithathele ingqalelo la manqaku alandelayo alandelayo ukukhulisa ukusebenza kakuhle kwayo:

- IiMeko zokuThenga kakhulu/eziThengisiweyo: Imida yemveli ye-0.80 ye-overbought kunye ne-0.20 yeemeko ezithengisiweyo zizinto zokuqala. Lungisa la manqanaba ukuze alungele ukuziphatha kwembali ye-asethi kunye neemeko zemarike zangoku.

- Umgca woMqondiso weCrossovers: Nika ingqalelo kumgca we-%K owela umgca we-%D. I-crossover engaphezulu komgca we-%D inokuba lithuba lokuthenga, ngelixa i-crossover engezantsi inokucebisa ukuba lixesha lokuthengisa.

- Ukwahluka: Hlala ujonge iyantlukwano phakathi kweStochRSI kunye nexabiso njengoko zinokuba ngabandulela umva. Nangona kunjalo, qinisekisa ngezalathi ezongezelelweyo ukuphepha iipositi zobuxoki.

- UQinisekiso kunye nezinye izalathisi: Sebenzisa izixhobo zokuhlalutya ezongezelelweyo zobugcisa ezifana nemilinganiselo ehambayo, i-MACD, okanye iipateni zekhandlela zokuqinisekisa izibonakaliso ze-StochRSI, ezinokukhokelela kwizigqibo zokuthengisa ezinamandla.

- Ulungelelwaniso lokuguquguquka: Kwiimarike eziguquguqukayo kakhulu, iStochRSI inokunika rhoqo kwaye ngamanye amaxesha imiqondiso elahlekisayo. Lungisa ubuntununtunu be-StochRSI okanye i-overbought/oversold thresholds ukuze ihambelane nokuguquguquka kwemarike.

- Ulawulo lwengozi: Nokuba kukho isalathisi esithembekileyo njengeStochRSI, kubalulekile ukuziqhelanisa nolawulo lomngcipheko oluvakalayo. Cwangcisa ii-odolo ze-stop-losss kunye nomngcipheko wepesenti encinci yemali yokurhweba kuyo nayiphi na into trade.

| Ukuqwalaselwa Okubalulekileyo | inkcazelo |

|---|---|

| Amanqanaba athengwe kakhulu/athengisiweyo | Lungisa imida ukuze ilingane i-asethi kunye okungazinzi kweemalike. |

| Crossovers | Beka esweni i-%K kunye ne-%D yomgca wokunqamleza ukuze ufumane iimpawu ezinokubakho zokuthenga/ukuthengisa. |

| Ukuchithwa | Jonga ukwahluka kwesalathi-xabiso kwaye uqinisekise ngezinye izixhobo. |

| Izalathisi ezongezelelweyo | Qinisekisa imiqondiso kunye nezinye iindlela zokuhlalutya zobugcisa. |

| Ulungelelwaniso lwe-Volatility | Lungisa ubuntununtunu kunye nemida kwiimarike eziguquguqukayo. |

| Ulawulo lwengozi | Qasha ii-odolo zokuyeka ilahleko kwaye ulawule trade ubungakanani. |

Ngokudibanisa iStochRSI kwisicwangciso esibanzi sokurhweba kunye nokudibanisa kunye nezinye izixhobo zokuhlalutya zobugcisa, tradeI-rs inokuhamba ngcono kwiingxaki zentengiso kwaye yenze izigqibo ezinolwazi ngakumbi.

3.1. Ukuchongwa kweeMeko zokuThenga kakhulu kunye nokuThengiswa ngokuNgakumbi

Ukuchithwa yenye ingqikelelo ebalulekileyo xa usebenzisa iStochRSI. Kwenzeka xa ixabiso le-asethi lihamba kwelinye icala lesalathisi. A ukuhlukana kwe-bullish kwenzeka xa ixabiso lirekhoda eliphantsi, kodwa i-StochRSI yenza i-high low low. Oku kuphakamisa ukuthotywa kwesantya esisezantsi, kunye traders inokulindela ukunyuka kwamaxabiso okuzayo. Kwelinye icala, a ukuhlukana komoya kuxa ixabiso libetha phezulu phezulu ngelixa i-StochRSI ibeka umgangatho ophantsi, ebonisa intshukumo yexabiso elinokubakho ngaphambili.

| Uhlobo lweDivergence | Price Action | Isenzo seStochRSI | Umqondiso onokubakho |

|---|---|---|---|

| Ukunyusa | Ngaphantsi | Ephakamileyo Phantsi | Intshukumo ePhezulu |

| Ukukhupha | Phezulu Phezulu | Phantsi Phezulu | Intshukumo ezantsi |

The Ulungiselelo lweStochRSI yenye into traders banokuhlengahlengisa ukuze balungele isimbo sabo sorhwebo kunye neenjongo. Useto olungagqibekanga lubandakanya i-14-ixesha elibekiweyo, kodwa oku kunokuguqulwa kubuntununtunu obungakumbi okanye ukugudiswa. Ixesha elibekelwe ixesha elifutshane linokubonelela ngemiqondiso yangaphambili kodwa linokonyusa umngcipheko weziphumo zobuxoki. Ngokuchaseneyo, ixesha elide linokunikela ngemiqondiso ethembeke ngakumbi ngendleko yexesha.

Ukuxokomezela uhlalutyo mkhuba inokuphucula ngakumbi ukusebenza kweStochRSI. Kwi-uptrend eyomeleleyo, iimeko ezithengiwe ngokugqithisileyo zinokubonisa kancinci ukuguqulwa okubalulekileyo, njengoko intengiso inokuqhubeka nokutyhala phezulu. Ngokufanayo, kwi-downtrend, iimeko ezithengiswa kakhulu zinokuthi zingabonisi ukuguqulwa kwangoku. Ukuqonda utyekelo oluxhaphakileyo kunokunceda traders thatha isigqibo malunga nendlela yokutolika kunye nokusebenza kufundo lweStochRSI.

- Kwi-Utrends: Iimeko ezithengwe ngokugqithisileyo zisenokungabalulekanga kangako; khangela iidiphu njengamathuba okuthenga.

- Kwi-Downtrends: Iimeko ezithengiswe ngaphezulu zisenokuqhubeka; iirali zingaba ngamathuba anqongopheleyo.

Ulawulo lwengozi kubaluleke kakhulu xa urhwebo olusekwe kwiimpawu zeStochRSI. Traders kufuneka basoloko besebenzisa ukumisa ilahleko ukukhusela kwiintshukumo zemarike ezichasene nezikhundla zabo. Ukongeza, ubukhulu be-a trade kufuneka ilinganiswe ngokwe trader ukunyamezela umngcipheko kunye nokuguquguquka kwemarike.

Okokugqibela, kufanelekile ukuba uqaphele ukuba iStochRSI sisixhobo nje esinye kwi trader's arsenal. Urhwebo oluyimpumelelo luhlala lufuna a indlela epheleleyo, kuthathelwa ingqalelo izinto ezisisiseko, uluvo lwemarike, kunye nezinye izalathisi zobugcisa ecaleni kweStochRSI. Ngokwenza njalo, traders unokwenza izigqibo ezinolwazi ngakumbi kwaye ujikeleze iimarike ngokuzithemba okukhulu.

3.2. Ukuqaphela iBullish kunye neBearish Divergences

Ukuchonga iiyantlukwano: Indlela yokuHamba ngeNyathelo

- Beka esweni iNdlela: Qalisa ngokuqwalasela indlela jikelele kwitshathi yexabiso. Ngaba imakethi ijonge phezulu, ihla, okanye ibotshelelwe kuluhlu?

- Fumana Okugqithisileyo kwisenzo seXabiso: Jonga iincopho zamva nje kunye nemikhombe kwitshathi yexabiso. Ezi ngongoma zakho zereferensi yokuthelekisa kunye ne-Stochastic RSI.

- Thelekisa kunye ne-Stochastic RSI: Ukulungelelanisa iincopho kunye nemigqomo kwitshathi yexabiso kunye neendawo eziphakamileyo ezihambelanayo kunye nezantsi kwi-Stochastic RSI. Ngaba zihamba ngemvisiswano, okanye ngaba kukho ukungangqinelani?

- Chonga udidi loMahluko:

- Ukwahlukana kweBullish: Ixabiso lenza i-low low, kodwa i-Stochastic RSI yenza i-high low low.

- I-Bearish Divergence: Ixabiso lenza ukuphakama okuphezulu, kodwa i-Stochastic RSI yenza umgangatho ophantsi.

- Funa Isiqinisekiso: Ngaphambi kokuba usebenze ngokuhlukana, linda iimpawu ezongezelelweyo ezifana ne-crossover kwi-Stochastic RSI okanye i-pattern breakouts kwitshathi yexabiso.

- Vavanya Ngokuchasene nezinye izalathisi: Qinisekisa ukuhlukana kunye nezinye izibonakaliso zobugcisa ezifana nemilinganiselo ehambayo, i-MACD, okanye ivolumu yesignali yokuthengisa eyomeleleyo.

Iingqwalasela eziPhambili Xa Ukwahluka koRhwebo

- Umonde Ubalulekile: Ukutsiba umpu phambi kokuqinisekiswa okucacileyo kunokukhokelela ekuqalweni kobuxoki. Lindela ukuba imarike inike umqondiso ocacileyo.

- Imiba yokomelela koMkhwa: Iiyantlukwano azithembekanga kangako kwiimarike ezithe gqolo ezihamba phambili apho umfutho unokugqithisa umqondiso wokwahlukana.

- Ulawulo lwengozi: Ngalo lonke ixesha sebenzisa imiyalelo yokuyeka ilahleko ukunciphisa umngcipheko kwimeko apho iyantlukwano ingabangeli ukuguqulwa kwexabiso elilindelekileyo.

- Umxholo weMarike: Qwalasela iimeko zemarike ngokubanzi kunye neendaba zoqoqosho ezinokuphembelela amaxabiso e-asethi kwaye zisenokuthi zingasebenzi ukuseta umahluko.

Ukusebenzisa iDivergences ecaleni kwamanye amaQhinga

- Iipateni zexabiso: Dibanisa ukwahluka kunye neepatheni zexabiso zakudala njengentloko kunye namagxa, oonxantathu, okanye imiphezulu ephindwe kabini/ezantsi ukudityaniswa kweempawu.

- Fibonacci Amanqanaba: Sebenzisa amanqanaba okubuyisela i-Fibonacci ukufumana amanqaku anokuthi abuyele umva ahambelana neempawu zokwahlukana.

- Iimviwo zezibane: Jonga i-bullish okanye i-bearish ye-candlestick iipateni zokuqinisekisa imiqondiso yokubuyisela umva ephakanyiswe yiyantlukwano.

Ngokudibanisa iiyantlukwano kwisicwangciso esibanzi sokurhweba kunye nokuqwalasela umxholo obanzi wemarike, traders inokuphucula inkqubo yabo yokuthatha izigqibo kwaye inokuthi inyuse izinga lempumelelo yabo kwiimarike.

3.3. Ukudibanisa nezinye izalathisi zobuGcisa

Ukudibanisa I-Stochastic RSI ne UkuPhakamisa Umyinge (EMA) inokunikela traders indlela eguqukayo yoqinisekiso lwentsingiselo kunye nokuchaneka komqondiso. I-EMA ibonelela ngexabiso eligudisiweyo eliphendula ngokukhawuleza kwiinguqu zexabiso zamva nje kunomndilili ohambahambayo olula. Xa i-Stochastic RSI iwela ngaphezulu okanye ngaphantsi kwe-EMA, inokuba luphawu lotshintsho kwisantya somkhwa.

Izalathi zevolumu, efana ne IVolumu ekwi-Balance (OBV), inokuphinda incedise i-Stochastic RSI ngokuqinisekisa amandla omzila. I-OBV ekhulayo kunye ne-Stochastic RSI ehamba ngaphandle kwendawo ethengiswayo ingabonisa ukunyuka okunamandla, ngelixa i-OBV ehlayo inokuqinisekisa uphawu lwe-bearish kwi-Stochastic RSI.

Amanqanaba okubuyiselwa kweFibonacci unikezela ngolunye uluhlu lohlalutyo xa lusetyenziswa kunye ne-Stochastic RSI. TradeI-rs inokubukela i-RSI ye-Stochastic ukubonisa ukuguqulwa kumanqanaba angundoqo e-Fibonacci, ahlala esebenza njengenkxaso okanye ukuchasana. Olu kudibanisa lunokuba namandla ngokukodwa ngexesha lokuphinda libuyele kwindlela eqinile.

Iipateni zeekhandlela, ezifana ne-doji, iihamile, okanye iipateni ezigubungelayo, zinokunika uqinisekiso olubonakalayo lokuguqulwa okunokwenzeka okanye ukuqhubeka kwentsingiselo. Xa ezi pateni zisenzeka ngokudibeneyo neempawu ze-Stochastic RSI, inokuphucula i trade ukuthembeka kokuseta.

Ukudibanisa i-RSI ye-Stochastic kunye nezinye izibonakaliso zobugcisa zivumela indlela eninzi yokuhlalutya imarike. Nantsi itheyibhile eshwankathela ezinye zendibaniselwano:

| Stochastic RSI + | Injongo yokudibanisa |

|---|---|

| MACD | Qinisekisa iimeko ezithengwe ngokugqithisileyo/ezithengiswe ngokugqithisileyo kwaye uqinisekise ukuguqulwa kwendlela |

| RSI | Ukubonelela ngemiqondiso ehambelanayo yokunciphisa iimpawu zobuxoki |

| Bollinger Nyanda | Chonga uhlengahlengiso olunokwenzeka okanye ukuqhubeka |

| Amanqanaba okuxhasa / okuchasa | Qinisa trade imiqondiso enobuchule bokutshatisa |

| ema | Qinisekisa intsingiselo yentsingiselo kunye nokutshintsha kwesantya |

| Iimpawu Zomqulu | Qinisekisa amandla entsingiselo kunye nokuguqulwa okunokwenzeka |

| Fibonacci Retracement | Amabala okubuyisela umva kumanqanaba angundoqo enkxaso/enkcaso |

| nesiphatho Iipatheni | Ukuqinisekiswa okubonakalayo kweempawu ze-Stochastic RSI |

ukohlulwa yohlalutyo kwaye cross-verification ngokusebenzisa ezi ndibaniselwano kunokukhokelela ekwenzeni izigqibo ezinolwazi kurhwebo. Nangona kunjalo, traders kufuneka bazi ukuba kunokwenzeka inzima kakhulu isicwangciso sabo kunye nezalathi ezininzi kakhulu, nto leyo enokukhokelela uhlalutyo ukukhubazeka. Ukulinganisa ukulula kunye nokucokisa kungundoqo kwisicwangciso esisebenzayo sokurhweba.

4. Zeziphi ezona zicwangciso-buchule zokuSebenzisa i-Stochastic RSI?

Iimarike zokuManyaniswa

Ngexesha lokudibanisa, i-Stochastic RSI inokunceda traders ukuchonga ukuqhambuka okunokwenzeka. A ukucutha uluhlu kwi-RSI ye-Stochastic, efana nokucutha ixabiso, inokwandulela ukuphuka. TradeI-rs kufuneka ibeke iliso kwijika elibukhali ukusuka kuluhlu oluphakathi (inqanaba le-50), elinokuthi libonise isalathiso sokuqhambuka. Izikhundla zingaqaliswa xa i-Stochastic RSI iqinisekisa ulwalathiso lokuqhawula, kunye nokuqinisekiswa okongeziweyo kwisenzo sexabiso.

| Imeko yeMarike | Stochastic RSI Strategy | isiqinisekiso |

|---|---|---|

| Ukuhlanganiswa | Jonga iRSI ukucudisa | Inyathelo lokuqhambuka kwexabiso |

Iimarike eziguquguqukayo

Kwiimarike eziguquguqukayo, i-Stochastic RSI ingasetyenziselwa ukulinganisa utshintsho lwesantya. Ukuhamba ngokukhawuleza kwi-Stochastic RSI kunokubonisa ukuthenga okunamandla okanye uxinzelelo lokuthengisa. Ngamaxesha anjalo, tradeI-rs inokusebenzisa ixesha elifutshane le-Stochastic RSI ukubamba olu tshintsho lukhawulezayo. Trades ngokwesiqhelo zexesha elifutshane, capitalisation kwiintshukumo amaxabiso abukhali.

| Imeko yeMarike | Stochastic RSI Strategy | Trade ubude bexesha |

|---|---|---|

| aziphethe ngayo | Iinguqu zexesha elifutshane | Ixesha elifutshane |

Ukurhweba ngokwahlukana

Ukwahlukana phakathi kwe-Stochastic RSI kunye nesenzo sexabiso sinokuba ngumqondiso onamandla traders. A ukuhlukana kwe-bullish kwenzeka xa amaxabiso esenza ukwehla okutsha, kodwa i-Stochastic RSI yenza ukwehla okuphezulu, okucebisa ukuba buthathaka ukuhla. Ngokuchaseneyo, a ukuhlukana komoya kuxa amaxabiso ebetha phezulu entsha kunye ne-Stochastic RSI yenza umgangatho ophantsi, obonisa ukwehla okunyukayo. Le yantlukwano inokwandulela ukuguqulwa kwendlela.

| Uhlobo lweDivergence | Price Action | I-Stochastic RSI | Isiphumo Esilindelekileyo |

|---|---|---|---|

| Ukunyusa | Intsha ephantsi | Ephantsi kakhulu | Ukubuyela umva ukuya phezulu |

| Ukukhupha | Intsha ephezulu | Uphakamileyo ophantsi | Ukubuyela umva ukuya kwicala elisezantsi |

Ukudibanisa i-RSI ye-Stochastic kunye nezinye izalathisi

Moving ezomhlaba

Ukudibanisa Stochastic RSI nge ukuhamba kwemida inokucoca imiqondiso kwaye inike umxholo wentsingiselo. Umzekelo, ukuthatha kuphela imiqondiso yokuthenga xa ixabiso lingaphezulu komndilili oshukumayo kunokuphucula amathuba okuphumelela trade kwi-uptrend. Ngokuchaseneyo, ukuthengisa xa ixabiso lingaphantsi komndilili ohambahambayo kwi-downtrend ihambelana nesikhokelo esikhoyo semarike.

Bollinger Nyanda

Ukudibanisa Stochastic RSI kunye Bollinger Nyanda inikeza ulwazi malunga nokuguquguquka kunye nokugqithiswa kwamaxabiso. Ukufundwa kwe-Stochastic RSI ngaphezu kwe-80 xa ixabiso lithinta i-Bollinger Band ephezulu ingabonakalisa imeko ethe kratya, ngelixa ukufundwa ngaphantsi kwe-20 kunye nexabiso kwi-band ephantsi ingabonisa i-oversold state.

Iimpawu Zomqulu

Iimpawu zevolumu ecaleni kwe-Stochastic RSI inokuqinisekisa okanye ukuphikisa amandla emva kokuhamba. Ngokomzekelo, ukunyuka kwexabiso elinyukayo kunye ne-Stochastic RSI ephezulu kunye nokunyusa umthamo kunokuqinisekisa uvakalelo lwe-bullish. Ngokwahlukileyo koko, ukuba ivolumu iyehla ngexesha lokuqhawuka, kunokubonisa ukunqongophala kolweyiseko.

Ukulungelelanisa i-RSI ye-Stochastic kwiiNdlela zokuRhweba

Trading Day

Usuku traders banokuzuza kwi iimpawu ezikhawulezayo inikwe yi-RSI ye-Stochastic. Ukusebenzisa ixesha elifutshane kunye nokudibanisa kunye nokuphulwa kwamanqanaba okanye iipatheni zamakhandlela kunokukhokelela ekusebenzeni trade ukungena kunye nokuphuma kulo lonke usuku lokurhweba.

Ukurhweba

Ukuguquka traders bangakhetha i ixesha elide ukuze i-RSI ye-Stochastic igudise ukuguquguquka kwexesha elifutshane. Ukurhweba nge-Swing kubandakanya ukubamba izikhundla iintsuku ezininzi okanye iiveki, ngoko ke ukulungelelanisa i-Stochastic RSI kunye nokuphakama kweveki kunye ne-lows kunokuba luncedo ngaphezu kokuguquguquka kwemihla ngemihla.

Indawo yokurhweba

indawo traders inokusebenzisa iStochastic RSI ukuchonga i ukomelela kwendlela kwiinyanga okanye iminyaka. Ukusebenzisa i-Stochastic ye-RSI yexesha elide kunokunceda ekunqumeni iindawo ezifanelekileyo zokungena kunye nokuphuma kwizikhundla ezenza imali kwiintshukumo ezinkulu zemarike.

Iingcebiso ezisebenzayo ze-Stochastic RSI Traders

- Izicwangciso ze-Backtest ngaphambi kokuzisebenzisa kwiimarike eziphilayo ukuqonda ukusebenza kwazo kwiimeko ezahlukeneyo zemarike.

- ukusebenzisa amaxesha amaninzi ukuqinisekisa imiqondiso kunye nokufumana imbono ebanzi yemarike.

- Soloko usebenza ulawulo lwengozi ubuchule, njengemiyalelo yokuyeka ilahleko, ukukhusela kwiintshukumo ezimbi zemarike.

- Yazi ukukhutshwa kwezoqoqosho kunye neziganeko zeendaba oko kunokubangela utshintsho ngesiquphe kwimvakalelo yentengiso, enokuba nefuthe kufundo lwe-Stochastic RSI.

- Ngokuqhubekayo vavanya kwaye usulungekise isicwangciso sakho sokurhweba ngokusekelwe ekusebenzeni kunye nokutshintsha ukuguquka kweemarike.

4.1. Iindlela zokulandela izicwangciso

Ukudibanisa I-Stochastic RSI ukuya kwindlela elandelayo iqhinga libandakanya amanyathelo amaninzi. Okokuqala, chonga umzila jikelele usebenzisa i-avareji ehamba phambili yexesha elide. Ukuba ixabiso lingaphezulu komyinge ohambahambayo, gxininisa kwizikhundla ezide; ukuba ngaphantsi, izithuba ezimfutshane zithandeka ngakumbi.

| Uhlobo lweNdlela | Isikhundla sexabiso | Stochastic RSI Strategy |

|---|---|---|

| Ukuphumla | Ngaphezulu kwe-MA | Thenga xa i-Stochastic RSI ihamba ngaphezu kwama-80 emva kokudipha |

| Downtrend | Ngaphantsi kwe-MA | Thengisa / emfutshane xa i-Stochastic RSI ihamba ngaphantsi kwe-20 emva kokunyuka |

Nje ukuba isikhokelo sisekwe, linda i-Stochastic RSI ukuba ibonise ukutsalwa kwakhona ngaphakathi kwendlela. Oku kuqhelekile xa i-Stochastic RSI iphuma kwi-overbought (> 80) okanye i-oversold (<20) indawo.

Ukwahluka phakathi kwexabiso kunye ne-Stochastic RSI inokubonelela ngeembono ezixabisekileyo. Ukwahlukana kwe-bullish kwenzeka xa ixabiso lirekhoda ephantsi, kodwa i-Stochastic RSI yenza i-high low low, ebonisa ukuba unokubuyela umva okanye ubuthathaka kwi-downtrend. Ngakolunye uhlangothi, ukuhlukana kwe-bearish kwenzeka xa ixabiso lifika phezulu, kodwa i-Stochastic RSI yenza i-low high, enokuthi ibonise i-downtrend ezayo.

Ukulawula ngempumelelo ingozi, traders kufuneka ibeke ukumisa ilahleko. Kwizikhundla ezide, i-stop-loss ingafakwa ngaphantsi kwe-swing ephantsi yamva nje, kunye nezikhundla ezimfutshane, ngaphezu kwe-swing ephezulu yamva nje. Obu buchule buqinisekisa ukuba trader zikhuselwe ekuguqukeni kotshintsho ngequbuliso.

| Uhlobo lwendawo | Stop-Loss Placement |

|---|---|

| Long | Ngezantsi ujingi olusezantsi lwamva nje |

| Mfutshane | Ngaphezulu ujingi oluphezulu lwakutsha nje |

Trailing stop-ilahleko ziluncedo ngakumbi kwindlela yokulandela izicwangciso njengoko zivumela traders ukuhlala kwi trade okoko intsingiselo isaqhubeka, ngelixa usakhusela iinzuzo ukuba imeko iqala ukubuya umva.

kuba traders ifuna ukwandisa ukusebenza kweStochastic RSI kwindlela elandelayo, cinga ukusebenzisa a uhlalutyo lwamaxesha amaninzi. Ngokuqinisekisa iintsingiselo kunye neempawu zokungena kuzo zombini ixesha eliphezulu nelisezantsi, traders inokunyusa amathuba okungena a trade ngesantya esinamandla.

Khumbula, ngelixa i-RSI ye-Stochastic sisixhobo esinamandla, akufuneki isetyenziswe yodwa. Ukudibanisa kunye nezinye izixhobo zokuhlalutya lobugcisa kunye neendlela ezifanelekileyo zokulawula umngcipheko kubalulekile kwisicwangciso sokurhweba esipheleleyo.

4.2. IiTechnical Reversion ezithetha

Xa uthetha kunye kuthetha amacebo okubuyisela, kubalulekile ukudibanisa ulawulo lwengozi. Kuba ingeyiyo yonke imiqondiso ethengisiweyo okanye ethengisiweyo eya kubangela ukuguqulwa kwangoko kwintsingiselo, traders kufuneka ilungiselelwe iimeko apho ixabiso liqhubeka ukuthambekela kude nentsingiselo.

Ukuchithwa phakathi kwe-RSI ye-Stochastic kunye nexabiso linokusebenza njengesixhobo esinamandla sokuguqulwa kwentsingiselo traders. Ukwahlukana kwenzeka xa ixabiso lenza entsha okanye ephantsi, kodwa i-Stochastic RSI ayiqinisekisi le ntshukumo. Oku kunqongophala kokuqinisekiswa kunokucebisa ukuba umfutho uyancipha kwaye ukuguqulwa kwentsingiselo kunokuba kufuphi.

Ukubuya kwakhona linyathelo elixabisekileyo ekusulungekiseni amacebo okubuyisela umva. Ngokuhlalutya idatha yembali, traders banokumisela ukusebenza kwesicwangciso sabo phantsi kweemeko ezahlukeneyo zentengiso. Le nkqubo inokunceda ekulungiseni iiparameters ezifana nobude bomndilili ohambahambayo kunye nezicwangciso ze-Stochastic RSI ukuze zilungele kakuhle i-asethi. traded.

Ukunyanzelisa yenye into ethetha ukuguqulwa traders kufuneka ithathelwe ingqalelo. Ngexesha lokuguquguquka okuphezulu, amaxabiso angaphambuka ngakumbi kwintsingiselo, kwaye ukuguqulwa kunokuba ngokukhawuleza. Ngokwahlukileyo koko, iimeko eziguquguqukayo ezisezantsi zinokubonelela ngamathuba orhwebo achuliweyo anomngcipheko ophantsi.

Itheyibhile: Amacandelo aPhambili kwiiNdlela zokuBuyisa uBuchule

| ilungu | inkcazelo |

|---|---|

| Amanqanaba e-Stochastic RSI | I-Overbought (> 80) kunye ne-oversold (<20) ukufundwa kungabonisa amathuba anokuthi athethe amathuba okubuyisela. |

| Uluhlu lwexabiso eliphakathi | Sebenzisa i-avareji ehambayo ukumisela ixabiso 'elilungileyo' le-asethi. |

| Inkxaso kunye noKhuselo | Hlanganisa izibonakaliso ze-RSI ze-Stochastic kunye namanqanaba amaxabiso abalulekileyo ukuze uqinise trade ingqiqo. |

| Ulawulo lwengozi | Sebenzisa ngokuqinileyo yeka ilahleko kunye neethagethi zenzuzo zokulawula ilahleko enokubakho kwaye ubambe iinzuzo. |

| Ukuchithwa | Ukubeka iliso ekuhlukeni phakathi kwexabiso kunye ne-Stochastic RSI njengesalathisi sokubuyela umva kwexabiso. |

| Ukubuya kwakhona | Uvavanyo lweqhinga lokusebenza kwidatha yembali ukucokisa iiparamitha kunye nendlela. |

| Uvavanyo lokuguquguquka | Lungisa ubuntununtunu besicwangciso esisekwe kumanqanaba akhoyo okuguquguquka kweemarike. |

Iindlela zokubuyisela umva azikho isidenge kwaye zifuna indlela eqeqeshekileyo ekurhwebeni. Ngokudibanisa ukufundwa kwe-Stochastic RSI kunye nezinye izixhobo zokuhlalutya kunye nokugcina iprotocol eyomeleleyo yokulawula umngcipheko, tradeI-rs inokukhangela ngcono imiceli mngeni yorhwebelwano oluthetha ukuguqulwa.

4.3. IiNdlela zokuRhweba zokuQhutywa

Ukubandakanya i-Stochastic RSI kwisicwangciso sokurhweba ngokuqhawuka kubandakanya uthotho lwamanyathelo okuqinisekisa indlela eyomeleleyo:

- Chonga Uluhlu: Ngaphambi kokuba kuqhambuke, kufuneka kubekho uluhlu olubonakalayo lokurhweba. Oku ngokuqhelekileyo kusekwe ngokuchonga inkxaso ecacileyo kunye namanqanaba okumelana kwitshathi.

- Beka iliso kwi-RSI yeStochastic: Njengoko ixabiso livavanya la manqanaba, jonga i-RSI ye-Stochastic yeempawu ezinokuthi zenzeke. Ukuhamba ngaphaya kwe-80 okanye i-20 threshold ingaba ngumqondiso wokuqala wokunyusa ukunyuka.

- Qinisekisa ngesenzo seXabiso: Ukuqhawula kuqinisekiswa xa ixabiso lihamba ngaphaya koluhlu oluchaziweyo ngokukholelwa. Khangela i isiphatho sesibane sivale ngaphandle koluhlu lokuqinisekisa okongeziweyo.

- Vavanya uMqulu: Qinisekisa ukuba ugqabhuko luhamba kunye ne-spike kwivolumu, ebonisa ukuvumelana phakathi traders kwaye yongeza ukuthembeka kugqabhuko-dubulo.

- Cwangcisa iOdolo yokuPhulukana nokuLawulwa: Ukulawula umngcipheko, misela inqanaba lelahleko yokuyeka. Oku kubekwa nje ngaphakathi kuluhlu apho ugqabhuko lwenzekile.

- Sebenzisa iindawo zokuZimisa zokuLawula: Xa ukwindawo enengeniso, cinga ukusebenzisa ilahleko yokulandela yokuyeka ukuze ukhusele iinzuzo ngelixa usabonelela ngokuguquguquka kwesimo sokukhula.

- Phinda uvavanye ufundo lwe-Stochastic RSI: Hlala ubeka iliso kwi-RSI ye-Stochastic yeempawu zokuhlukana okanye ukubuyela kumanqanaba aqhelekileyo, anokuthi abonise ukuba umfutho uyancipha.

Itheyibhile: Uluhlu lwe-Stochastic RSI Breakout Trading

| inyathelo | inyathelo | Injongo |

|---|---|---|

| 1 | Chonga Uluhlu | Ukuseka amanqanaba enkxaso kunye nokumelana |

| 2 | Beka iliso kwi-RSI yeStochastic | Khangela utshintsho olukhawulezayo |

| 3 | Qinisekisa ngesenzo seXabiso | Qinisekisa ukuphuma kunye nokuhamba kwexabiso |

| 4 | Vavanya uMqulu | Qinisekisa amandla okuqhawuka kunye nohlalutyo lwevolumu |

| 5 | Cwangcisa iOdolo yokuPhulukana nokuLawulwa | Lawula umngcipheko wecala eliphantsi |

| 6 | Sebenzisa iindawo zokuZimisa zokuLawula | Khusela inzuzo ngelixa uvumela ukukhula |

| 7 | Phinda uvavanye ufundo lwe-Stochastic RSI | Beka iliso kwiimpawu zendlela yokudinwa |

Ulawulo lwengozi yinxalenye ebalulekileyo yokuthengisa ngokuqhawula kunye ne-Stochastic RSI. Ngelixa isixhobo sinokunika imiqondiso exabisekileyo, asiyiyo impazamo. Ukudibanisa kunye nezinye izibonakaliso zobugcisa, ezifana nemigangatho ehambayo okanye i-Bollinger Bands, inokubonelela ngembono ebanzi yeemeko zemarike kunye nokunceda ukucoca izibonakaliso zobuxoki.

Ukubuya kwakhona isicwangciso esibandakanya i-Stochastic RSI siyacetyiswa. Idatha yembali inokunika ukuqonda malunga nendlela le ndlela enokuthi isebenze ngayo phantsi kweemeko ezahlukeneyo zemarike, ukuvumela traders ukulungisa indlela yabo ngaphambi kokuba bayisebenzise kwiimarike eziphilayo.

umonde idlala indima ephambili ekurhwebeni kokuqhawuka. Ukulinda zonke iinqobo zokugweba zilungelelaniswe phambi kokuphumeza a trade kunokunceda ukuphepha ukuqhambuka kobuxoki kunye nokuphucula amathuba okungena trade ngesantya esinamandla emva kwayo.