1. Zeziphi ezona zalathisi zilungileyo Forex Ukurhweba?

The Forex imarike izele zizalathisi ezininzi. Traders baye benza ezabo izalathisi abazisebenzisayo ukukhohlisa nokuqonda imarike. Nangona kunjalo, kunzima ukutolika kunye nokusebenza kuso sonke isikhombisi ukuze ufumane esona silungileyo sokuqalisa kwakho. Ke ngoko, kukho izikhombisi ezidumileyo phakathi traders. Ndizihlele kwiiklasi ezi-4, njengoko kukhankanyiwe ngezantsi:

- Izikhombisi zeMpawu

- Momentum Izalathisi

- Iimpawu zoKhupheka

- Iimpawu Zomqulu

Ukuqonda kwakho, ndiza kubonelela ngesikhokelo sophononongo kwezi zixhobo. Masingene kuyo.

1.1. Iimpawu zomzila

Iimpawu zomzila zizixhobo ezibonisa isikhokelo kunye namandla omzila okhoyo kwimarike. Banokunceda traders chonga kwaye ulandele umkhwa, kunye nokubona ukuguqulwa okanye izilungiso ezinokubakho. Ezinye zezona zalathisi eziqhelekileyo zezi:

1.1.1. Ii-avareji ezihambayo (MA)

I-avareji ezihambayo zibalwa ngokuthatha ixabiso eliqhelekileyo lesibini semali ngexesha elithile. Zingasetyenziselwa ukugudisa ukuguquguquka kwexabiso kwaye zibonise isalathiso esipheleleyo sendlela. Ezona ntlobo zidumileyo ze-MA zezi umlinganiselo olula wokuhamba (SMA) kunye ne-exponential umlinganiselo ohambayo (EMA). I-SMA inika ubunzima obulinganayo kuwo onke amaxabiso, ngelixa i-EMA inika ubunzima obuninzi kumaxabiso amva nje.

1.1.2. Iibhanti zeBollinger (BB)

Bollinger iibhendi zibalwa ngokongeza kunye nokuthabatha ukutenxa okusemgangathweni ukusuka kumyinge ohambahambayo. Zingasetyenziselwa ukulinganisa ukuguquguquka kunye noluhlu lweentshukumo zexabiso.

TradeI-rs ingasebenzisa iibhendi zeBollinger ukuchonga umkhwa kunye namandla ayo, kunye neemeko ezithengisiweyo kunye nezithengisiweyo. Umzekelo, ubuchule obuqhelekileyo kukusebenzisa ibhendi ephakathi (umndilili ohambahambayo) njengesalathiso somkhondo kunye neebhendi eziphezulu nezisezantsi njengamanqaku anokubakho okubuyisela umva. Xa ixabiso lingaphezulu kwebhanti ephakathi, libonisa ukunyuka, kwaye xa ixabiso lingaphantsi kwebhanti ephakathi, libonisa i-downtrend.

1.1.3. IParabolic SAR (PSAR)

SAR Parabolic ibalwa ngokusebenzisa ifomyula ethathela ingqalelo isalathiso sexabiso, i-acceleration factor, kunye nenqanaba eligqithiseleyo. Ingasetyenziselwa ukuchonga intsingiselo kunye nesikhokelo sayo, kunye neendawo ezinokubakho zokubuyisela umva. Imimiselo engagqibekanga ye-Parabolic SAR yi-0.02 ye-acceleration factor kunye ne-0.2 yexabiso eliphezulu.

Traders unokusebenzisa iParabolic SAR ukulandela umkhondo kunye nesikhokelo sayo, kunye nokuseta i stop-ilahleko kunye namanqanaba okuthatha inzuzo. Umzekelo, ubuchule obuqhelekileyo kukusebenzisa iParabolic SAR njengendawo yokumisa umva, nto leyo ethetha ukuba inqanaba lelahleko lihlengahlengiswa ngokwexabiso leParabolic SAR. Xa iParabolic SAR ingaphezulu kwexabiso, ibonisa ukuhla komgangatho, kunye nenqanaba lelahleko lokuyeka limiselwe kwixabiso leParabolic SAR.

1.1.4. Ilifu le-Ichimoku (IC)

Ichimoku ilifu libalwa ngokusebenzisa imigca emihlanu esekelwe kumyinge wamaxabiso aphezulu naphantsi ngamaxesha ahlukeneyo. Zingasetyenziselwa ukuchonga umkhwa kunye nolwalathiso lwawo, kunye nenkxaso kunye namanqanaba okumelana. Imigca emihlanu yile:

- UTenkan-sen: Umyinge welona liphezulu liphezulu kunye nelona lisezantsi lisezantsi kwiiphiriyodi ezilithoba ezidlulileyo. Ikwabizwa ngokuba ngumgca wokuguqula.

- Kijun-sen: Umyinge welona liphezulu liphezulu kunye nelona lisezantsi lisezantsi kwixesha elidlulileyo le-26. Ikwabizwa ngokuba sisiseko.

- USenkou uthatha uA: Umyinge we-Tenkan-sen kunye ne-Kijun-sen bacebe amaxesha angama-26 ngaphambili. Ikwabizwa ngokuba lixesha eliphambili A.

- Senkou B: Umyinge welona liphezulu kunye nelisezantsi eliphantsi kwixesha elidlulileyo le-52 lamaxesha, licwangcise amaxesha angama-26 ngaphambili. Ikwabizwa ngokuba yindawo ekhokelayo B.

- Isithuba seChikou: Ixabiso lokuvala lexesha langoku, licwangciswe ngamaxesha angama-26 ngasemva. Ikwabizwa ngokuba yi-lagging span.

Ummandla phakathi kwe-Senkou Span A kunye ne-Senkou Span B ibizwa ngokuba yi-Ichimoku cloud. Izicwangciso ezingagqibekanga zelifu le-Ichimoku zi-9, 26, kunye namaxesha angama-52.

TradeI-rs inokusebenzisa ilifu le-Ichimoku ukuchonga intsingiselo kunye nesalathiso sayo, kunye nenkxaso kunye namanqanaba okumelana. Umzekelo, ubuchule obuqhelekileyo kukusebenzisa ilifu le-Ichimoku njengesalathisi sokuhamba kunye neminye imigca njengemiqondiso yokuqinisekisa. Xa ixabiso lingaphezulu kwelifu, libonisa ukunyuka, kwaye xa ixabiso lingaphantsi kwelifu, libonisa ukuhla. Xa ixabiso liwela ilifu, libonisa utshintsho olunokwenzeka.

1.1.5. Intengisovantages kunye ne-Disadvantages yeZalathi zoMgangatho

Intengisovantages yezalathi zentsingiselo zezi:

- Banokunceda traders chonga kwaye ulandele ukuthambekela, leyo yenye yezona migaqo ibalulekileyo kwi forex Isicwangciso sokurhweba.

- Banga kuphephe ukurhweba ngokuchasene nomkhwa, onokuthi ubangele ilahleko kunye nokuphazamiseka.

- Banokunceda hluza ingxolo kunye nokugxila kwicala eliphambili lemarike.

I-disadvantages yezalathi zentsingiselo zezi:

- Ba no kubakho Ukusalela, oku kuthetha ukuba abanakukwazi ukubonakalisa ngokuchanekileyo iimeko zemarike zangoku kwaye banokunika iimpawu zobuxoki okanye emva kwexesha.

- Ba no kubakho thobela, nto leyo ethetha ukuba yahlukile traders inokutolika ngokwahlukileyo kwaye inokusebenzisa izicwangciso ezahlukeneyo kunye neeparamitha.

1.2. Iimpawu zeMomentum

Iimpawu zeMomentum zizalathi ezilinganisa isantya kunye namandla eentshukumo zexabiso. Banokunceda traders ukulinganisa ukomelela kwentsingiselo, kunye nokuchonga iimeko ezithengwe ngokugqithisileyo nezithengiswe ngokugqithisileyo, iyantlukwano, kunye nokutshintsha ngamandla. Imizekelo yezona zalathisi zixhaphakileyo zezi:

1.2.1. Isalathiso samandla esihambelanayo (RSI)

The isalathiso samandla esihlobo ibalwa ngokusebenzisa ifomyula ethelekisa inzuzo eqhelekileyo kunye nelahleko ephakathi kwixesha elithile. Ingasetyenziselwa ukulinganisa ukukhawuleza kunye nobukhulu beentshukumo zexabiso. I RSI ukusuka kwi-0 ukuya kwi-100, kwaye ngokuqhelekileyo ithathwa njengexabiso elithe kratya xa lingaphezulu kwe-70 kwaye lithengiswe kakhulu xa lingaphantsi kwe-30. Ukusetwa okungagqibekanga kwe-RSI ngamaxesha angama-14.

TradeI-RSI inokusebenzisa i-RSI ukuchonga intsingiselo kunye namandla ayo, kunye neemeko ezithengiswe ngokugqithisileyo nezithengiswe kakhulu, iyantlukwano, kunye nokutshintsha ngokukhawuleza. Ngokomzekelo, ubuchule obuqhelekileyo kukusebenzisa i-RSI njengesalathisi sokuhamba kwaye ujonge amaxabiso e-RSI ngokuhambelana nenqanaba le-50. Xa i-RSI ingaphezulu kwe-50, ibonisa ukunyuka, kwaye xa i-RSI ingaphantsi kwe-50, ibonisa i-downtrend. Xa i-RSI iwela ngaphezulu okanye ngaphantsi kwinqanaba le-50, ibonisa utshintsho olunokwenzeka.

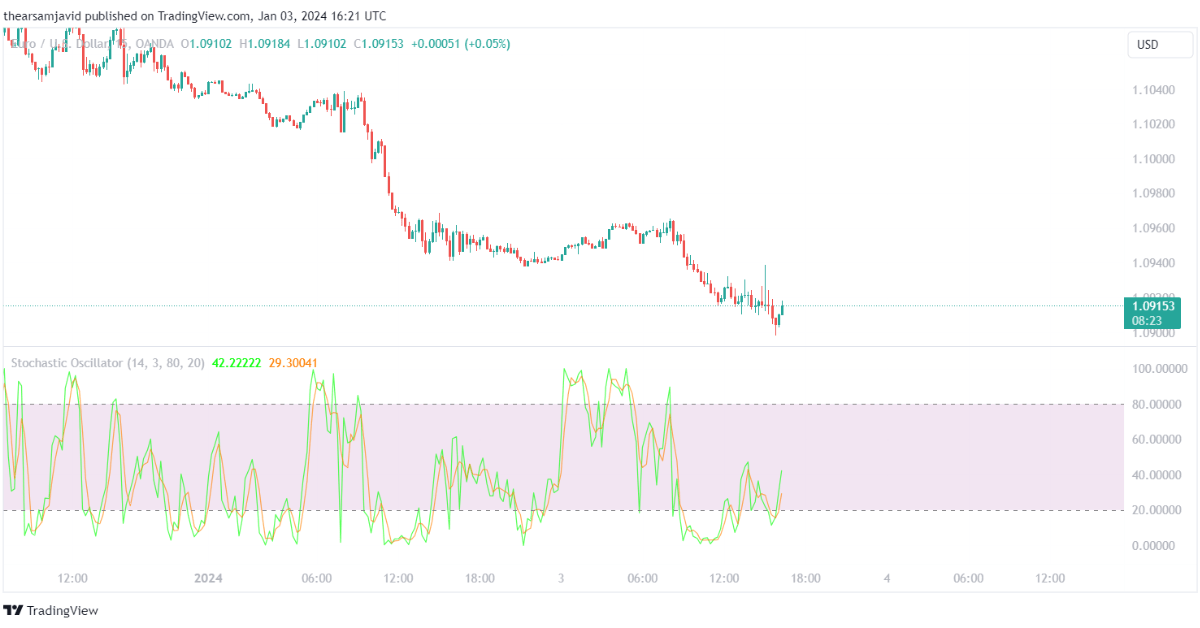

1.2.2. I-oscillator ye-Stochastic (STO)

I-oscillator ye-stochastic ithelekisa ixabiso lokuvala lexesha langoku kunye noluhlu lwamaxabiso kwixesha elithile. Ingasetyenziselwa ukulinganisa ukukhawuleza kunye nolwalathiso lweentshukumo zexabiso. I-oscillator yestochastic inemigca emibini: umgca we-%K kunye nomgca we-%D. Umgca we-%K ngowona mgca uphambili obonisa indawo yangoku yexabiso xa kuthelekiswa noluhlu. Umgca we-%D ngumgca womqondiso obonisa umndilili oshukumayo womgca we-%K.

TradeI-rs inokusebenzisa i-oscillator ye-stochastic ukuchonga intsingiselo kunye necala layo, kunye neemeko ezithengiswe ngokugqithisileyo nezithengiswe kakhulu, iyantlukwano, kunye nokutshintsha kwesantya. Ngokomzekelo, ubuchule obuqhelekileyo kukusebenzisa i-oscillator ye-stochastic njengesalathisi somkhwa kwaye ujonge amaxabiso e-stochastic ngokubhekiselele kwinqanaba le-50. Xa i-stochastic ingaphezulu kwe-50, ibonisa ukunyuka, kwaye xa i-stochastic ingaphantsi kwe-50, ibonisa i-downtrend.

1.2.3. I-avareji ye-convergence divergence (MACD):

Ukwahlukana okuphakathi kokuhamba okuphakathi izalathisi zisebenzisa ifomyula ethabatha ixesha elide Isantya eshukumayo sokuhamba ukusuka kumndilili oshukumayo wexesha elifutshane. Ingasetyenziselwa ukulinganisa isantya kunye nentsingiselo yeentshukumo zexabiso.

I-MACD inamacandelo amathathu: umgca we-MACD, umgca wesignali, kunye ne-histogram. Umgca we-MACD ngumgca oyintloko obonisa umahluko phakathi kwee-avareji ezimbini ezihambayo. Umgca wesignali ngumgca wesignali obonisa umyinge ohambahambayo womgca we-MACD. I-histogram yitshathi yebha ebonisa umahluko phakathi komgca we-MACD kunye nomgca wesignali. Izicwangciso ezingagqibekanga ze-MACD ziyi-12, i-26, kunye ne-9 yexesha elifutshane le-EMA, ixesha elide le-EMA, kunye nomgca wesignali, ngokulandelanayo.

Traders inokusebenzisa i-MACD ukuchonga intsingiselo kunye namandla ayo, kunye nokungafani kunye nokutshintsha ngokukhawuleza. Ngokomzekelo, ubuchule obuqhelekileyo kukusebenzisa i-MACD njengesalathisi sokuhamba kwaye ujonge amaxabiso e-MACD ngokuhambelana nenqanaba le-zero. Xa i-MACD ingaphezulu kwe-zero, ibonisa ukunyuka, kwaye xa i-MACD ingaphantsi kwe-zero, ibonisa i-downtrend. Xa i-MACD iwela ngaphezulu okanye ngaphantsi kwinqanaba le-zero, ibonisa utshintsho olunokuthi lubekho.

1.2.4. I-oscillator emangalisayo (AO)

Oscillator thabatha i-avareji ye-34 elula ukusuka kwi-avareji ye-5 elula ehambayo. Ingasetyenziselwa ukulinganisa isantya kunye nentsingiselo yeentshukumo zexabiso. I-oscillator eyoyikekayo icwangciswe njenge-histogram ejikeleza kwinqanaba elingu-zero.

Izicwangciso ezingagqibekanga ze-oscillator eyoyikekayo ziyi-5 kunye ne-34 yexesha elifutshane le-SMA kunye ne-SMA yexesha elide, ngokulandelanayo.

TradeI-rs inokusebenzisa i-oscillator eyoyikekayo ukuchonga intsingiselo kunye namandla ayo, kunye nokwahlukana kunye nokutshintsha kwesantya. Umzekelo, ubuchule obuqhelekileyo kukusebenzisa i-oscillator eyoyikekayo njengesalathisi somkhwa kwaye ujonge amaxabiso amangalisayo e-oscillator xa kuthelekiswa nenqanaba le-zero. Xa i-oscillator eyoyikekayo ingaphezulu kwe-zero, ibonisa ukunyuka, kwaye xa i-oscillator eyoyikekayo ingaphantsi kwe-zero, ibonisa i-downtrend. Xa i-oscillator eyoyikekayo iwela ngaphezulu okanye ngaphantsi kwinqanaba le-zero, ibonisa utshintsho olunokwenzeka.

1.2.5. Intengisovantages kunye ne-disadvantageIzalathi zeMomentum zinikwe ngezantsi:

IntengisovantageIimpawu zesantya zezi:

- Banokunceda traders linganisa amandla kunye necala yomzila, enokubanceda baqinisekise intsingiselo kunye nokuqhubeka kwayo.

- Ezi zalathi ukuchonga iimeko ezithengwe ngokugqithisileyo nezithengiswe ngokugqithisileyo, enokubanceda babone amanqaku anokubakho okubuyisela umva kunye neendawo zokuphuma.

I-disadvantageIimpawu zesantya zezi:

- Ba no kubakho elahlekisayo emacaleni okanye kwiimarike ezahlukeneyo, nto leyo enokuphumela kwizabhokhwe nokubhideka.

1.3. Iimpawu zokuguquguquka

Iimpawu zokuguquguquka zizalathi ezibonisa iqondo lokwahluka kunye nokungaqiniseki kwiintshukumo zamaxabiso. Banokunceda traders ukuvavanya i ingozi kunye nethuba kwimarike, kunye nokulungelelanisa ubungakanani bendawo kunye namanqanaba okuyeka-ilahleko ngokufanelekileyo. Ezinye zezona zalathisi zokuguquguquka ezisetyenziswa kakhulu zinikwe ngezantsi:

1.3.1. Umndilili woluhlu lwenyani (ATR)

Umndilili woluhlu lokwenyani isebenzisa ifomula ethatha i-avareji yoluhlu lwenyani kwixesha elithile. Uluhlu oluyinyani luphezulu lwala maxabiso mathathu alandelayo: iphezulu yangoku thabatha ephantsi yangoku, ixabiso elipheleleyo lomgangatho ophezulu wangoku uthabathe ukuvalwa kwangaphambili, kunye nexabiso elipheleleyo lelo eliphantsi uthabathe ukuvala kwangaphambili. Ingasetyenziselwa ukulinganisa ukuguquguquka kunye noluhlu lweentshukumo zexabiso. Ukuseta okumiselweyo kwe-ATR ngamaxesha ali-14.

Traders unokusebenzisa i-ATR ukuchonga ukuguquguquka kunye noluhlu lwemarike, kunye nokuseta ubungakanani bendawo kunye namanqanaba okulahleka kokuyeka. Umzekelo, ubuchule obuqhelekileyo kuku sebenzisa i-ATR njengento eguquguqukayo isalathisi kwaye ujonge amaxabiso e-ATR anxulumene nomndilili wembali. Xa i-ATR ingaphezulu komyinge, ibonisa i-market-volatility market, kwaye xa i-ATR ingaphantsi komyinge, ibonisa i-market-volatility market. Xa i-ATR inyuka okanye iyancipha kakhulu, ibonisa ukuphuka okanye ukuphazamiseka okunokwenzeka.

1.3.2. Ukutenxa okusemgangathweni (SD)

Ukutenxa emgangathweni kubalwa ngokusebenzisa ifomula elinganisa ukuba ixabiso litenxa kangakanani na kwintsingiselo kwixesha elithile. Ingasetyenziselwa ukulinganisa ukuguquguquka kunye nokusabalalisa kweentshukumo zexabiso. Okukhona ukutenxa komgangatho ophezulu, kokukhona ukuguquguquka okuphezulu, kwaye okukhona ukutenxa okusezantsi okusezantsi, kokukhona kusezantsi ukuguquguquka. Ukuseta okumiselweyo kokutenxa okusemgangathweni ngamaxesha angama-20.

Traders banokusebenzisa ukutenxa okusemgangathweni ukuchonga ukuguquguquka kunye nokusasazwa kwemarike, kunye nokuchonga iimeko ezithengwe ngokugqithisileyo nezithengiswe ngokugqithisileyo, iyantlukwano, kunye nokomelela kwentsingiselo. Umzekelo, ubuchule obuqhelekileyo kukusebenzisa ukutenxa okusemgangathweni njengesalathisi sokuguquguquka kunye nokujonga amaxabiso okutenxa okusemgangathweni ngokunxulumene nomndilili wembali. Xa ukuphambuka okusemgangathweni kungaphezulu komyinge, kubonisa i-market-volatility market, kwaye xa ukuphambuka okusemgangathweni kungaphantsi komyinge, kubonisa i-market-volatility market. Xa ukutenxa okusemgangathweni kunyuka okanye kuncipha kakhulu, kubonisa ukuqhawuka okanye ukuphuka okunokwenzeka.

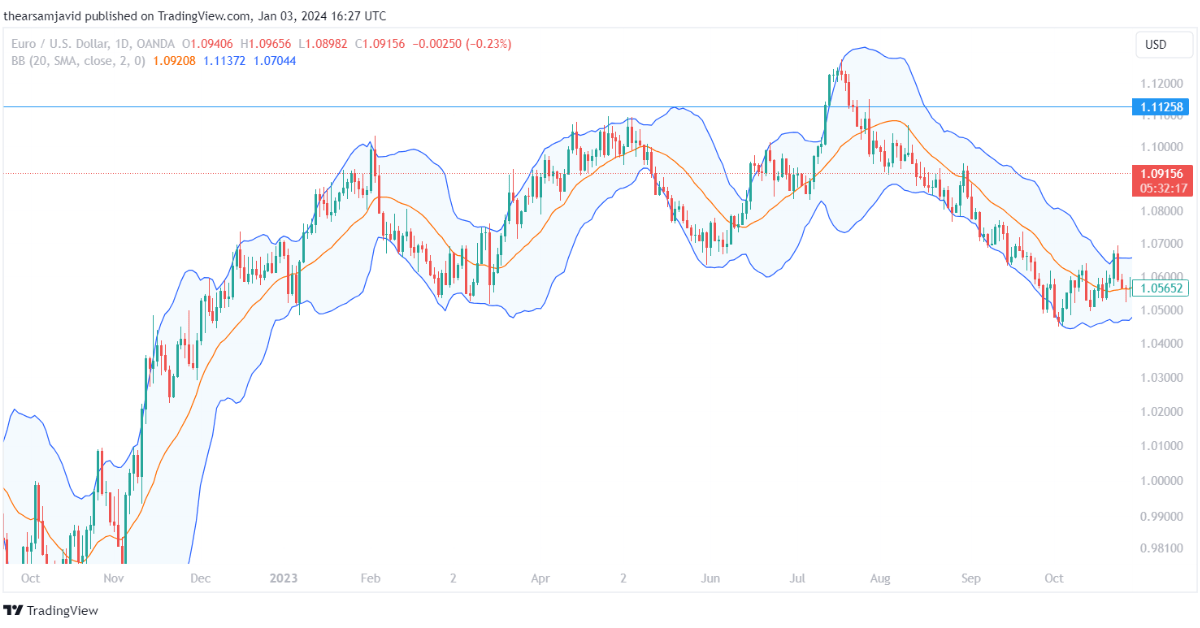

1.3.3. Iibhendi zeBollinger (BB)

Iibhendi zeBollinger zibalwa ngokongeza kunye nokukhupha ukuphambuka okusemgangathweni ukusuka kumyinge ohambahambayo. Zingasetyenziselwa ukulinganisa ukuguquguquka kunye noluhlu lweentshukumo zexabiso. Ukutenxa okusemgangathweni ngumlinganiselo wamanani obonisa ukuba ixabiso litenxa kangakanani kumndilili. Ukuphakama komgangatho wokutenxa, ukubanzi kweebhanti, kunye nokusezantsi ukutenxa okusemgangathweni, ukucutha bands. Izicwangciso ezingagqibekanga kwiibhendi zeBollinger ziyi-SMA ye-20 kunye ne-2-standard deviation.

TradeI-rs ingasebenzisa iibhendi zeBollinger ukuchonga ukuguquguquka kunye noluhlu lwemarike, kunye nentsingiselo kunye namandla ayo, iimeko ezithengiswa kakhulu kunye neemeko ezithengiswayo, kunye namanqaku anokuthi abuyele umva. Ngokomzekelo, ubuchule obuqhelekileyo kukusebenzisa iibhendi zeBollinger njengesalathisi sokuguquguquka kwaye ujonge ububanzi beebhendi ngokumalunga nomyinge wembali. Xa iibhendi zibanzi, zibonisa i-market volatility market, kwaye xa iibhendi zincinci, zibonisa i-market volatility market. Xa iibhendi zanda okanye zikhontrakthi kakhulu, oko kubonisa ukuphuka okanye ukuphuka okunokwenzeka.

1.3.4. Keltner channels (KC)

Keltner channels zibalwa ngokudibanisa nokuthabatha umndilili woluhlu oluyinyani ukusuka kumndilili ohambahambayo. Zingasetyenziselwa ukulinganisa ukuguquguquka kunye noluhlu lweentshukumo zexabiso. Uluhlu oluyinyani oluyi-avareji ngumlinganiselo obonisa umndilili woluhlu lwenyani kwixesha elithile. Uluhlu oluyinyani luphezulu lwala maxabiso mathathu alandelayo: iphezulu yangoku thabatha ephantsi yangoku, ixabiso elipheleleyo lomgangatho ophezulu wangoku uthabathe ukuvalwa kwangaphambili, kunye nexabiso elipheleleyo lelo eliphantsi uthabathe ukuvala kwangaphambili. Uphinda-phindo yinto emisela ukuba ububanzi okanye bucuthe kangakanani na imijelo.

TradeI-rs inokusebenzisa iziteshi ze-Keltner ukuchonga ukuguquguquka kunye noluhlu lwemarike, kunye nentsingiselo kunye namandla ayo, iimeko ezithengiswa kakhulu kunye neemeko ezithengiswayo, kunye namanqaku okubuyisela umva. Ngokomzekelo, ubuchule obuqhelekileyo kukusebenzisa iziteshi zeKeltner njengesalathisi sokuguquguquka kwaye ujonge ububanzi beetshaneli ezihambelana nomyinge wembali. Xa imijelo ibanzi, ibonisa imarike eguquguqukayo ephezulu, kwaye xa iziteshi zincinci, zibonisa i-market volatility market. Xa imijelo yanda okanye ikhontrakthi kakhulu, ibonisa ukuqhawuka okunokwenzeka okanye ukuphuka. Olunye ubuchule kukusebenzisa iziteshi zeKeltner njengesalathisi sokuhamba kwaye ujonge isalathiso kunye nokuthambeka kweetshaneli. Xa imijelo ihla inyuka, ibonisa i-uptrend, kwaye xa imijelo ihla, ibonisa i-downtrend. Xa imijelo ithe tyaba, ibonisa imarike esecaleni okanye ephakathi.

1.3.5. Intengisovantages kunye ne-Disadvantages yeZalathi zokuguquguquka

Intengisovantages zezalathi zokuguquguquka zezi:

- Banokunceda traders ukulinganisa umngcipheko kunye nethuba kwimarike, enokubanceda ukuba balawule imali kunye neemvakalelo zabo ngcono.

- Unokuhlengahlengisa ubungakanani bendawo yakho kunye namanqanaba okulahleka kokuyeka ngokweemeko zemarike ngezi zalathisi.

I-disadvantages zezalathi zokuguquguquka zezi:

- Ziyakwazi ukukhawuleza, oku kuthetha ukuba zingabonakali iimeko zemarike zangoku ngokuchanekileyo.

- Ziyakwazi ukulahlekisa kwiimarike ezihamba phambili okanye ezingaguquguqukiyo.

1.4. Iimpawu zomthamo

Iimpawu zomthamo zizalathi ezibonisa isixa kunye nobunzulu bomsebenzi wokurhweba kwimarike. Banokunceda tradeI-rs iqinisekisa ubunyani kunye nokubaluleka kweentshukumo zamaxabiso, kunye nokubona ukungalingani kobonelelo kunye nemfuno, ukuqhambuka, kunye ukuqokelela nokusasazwa izigaba. Ezinye zezona zalathisi zevolumu ezisebenzayo zezi:

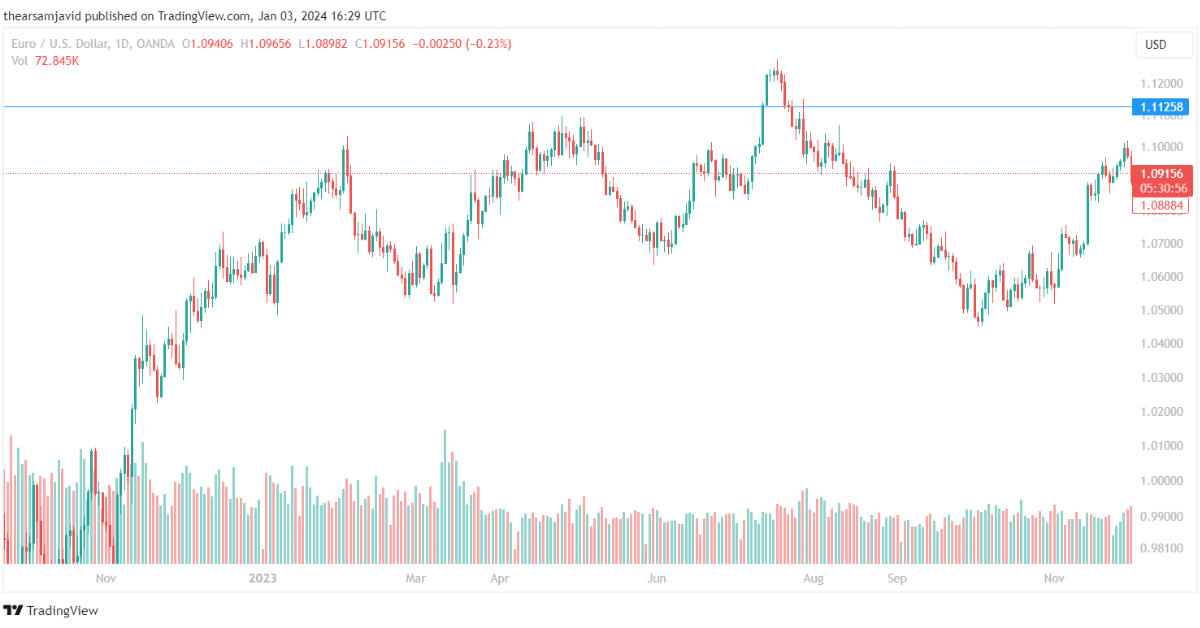

1.4.1. Umqulu

Umthamo yeyona nto ilula kwaye isisiseko sesalathisi somthamo. Ibonisa inani leeyunithi okanye iikhontrakthi ezikhoyo traded kwixesha elinikiweyo. Ingasetyenziselwa ukulinganisa umdla kunye nokuthatha inxaxheba kwabathathi-nxaxheba bemarike. Ukuphakama komthamo, umdla ophezulu kunye nokuthatha inxaxheba, kwaye ivolumu ephantsi, iyancipha umdla kunye nokuthatha inxaxheba.

TradeI-rs inokusebenzisa umthamo ukuqinisekisa ukunyaniseka kunye nokubaluleka kweentshukumo zexabiso. Umzekelo, ubuchule obuqhelekileyo kukusebenzisa umthamo njengesalathisi sokuqinisekisa kwaye ujonge ulungelelwaniso phakathi komthamo kunye nexabiso. Xa umthamo kunye nexabiso lihamba ngendlela efanayo, libonisa ukunyakaza kwexabiso elisebenzayo kunye nebalulekileyo, kwaye xa umthamo kunye nexabiso lihamba kwelinye icala, libonisa ukunyakaza kwexabiso elingasebenziyo nelingabalulekanga.

1.4.2. Umthamo wokulinganisela (OBV)

Umthamo wokulinganisela ubalwa ngokusebenzisa ifomyula eyongeza okanye ekhupha umthamo wexesha langoku ukuya okanye ukusuka kwinani eliqokelelweyo lamaxesha adlulileyo, ngokuxhomekeke kwisalathiso sokuhamba kwexabiso. Ingasetyenziselwa ukulinganisa uxinzelelo oluqokelelweyo lokuthenga nokuthengisa kwimarike. Iphezulu i-OBV, iphezulu yoxinzelelo lokuthenga, kunye ne-OBV ephantsi, iyancipha uxinzelelo lokuthengisa.

Ungasebenzisa i-OBV ukuqinisekisa ukunyaniseka kunye nokubaluleka kweentshukumo zexabiso, kunye nokuchonga ukuhlukana kunye namandla okuhamba. Umzekelo, ubuchule obuqhelekileyo kukusebenzisa i-OBV njengesalathisi sokuqinisekisa kwaye ujonge ulungelelwaniso phakathi kwe-OBV kunye nexabiso. Xa i-OBV kunye nexabiso lihamba ngendlela efanayo, libonisa ukunyakaza kwexabiso elisebenzayo nelibalulekileyo, kwaye xa i-OBV kunye nexabiso lihamba kwelinye icala, libonisa ukunyakaza kwexabiso elingasebenziyo nelingabalulekanga. Xa i-OBV inyuka okanye iyancipha kakhulu, ibonisa ukuchithwa kwexabiso elinokwenzeka okanye ukuchithwa.

1.4.3. Intengisovantages kunye ne-Disadvantages yeZalathi zoMqulu

IntengisovantageIzikhombisi zevolumu zezi:

- Banokuqinisekisa ukunyaniseka kunye nokubaluleka kweentshukumo zexabiso.

- Banokubona ukungalingani kobonelelo kunye nemfuno, ukuchonga iindawo ezinokuthi zibekho zokubuyisela umva kunye neendawo zokungena.

- Zingaba ngamanqanaba okuqokelela kunye nokusabalalisa.

I-disadvantageIzikhombisi zevolumu zezi:

- Kunokuba nzima ukutolika kwabanye traders.

2. Uyimisela njani eyona isebenzayo Forex Iimpawu?

Ukumisela okusebenzayo Forex izalathisi zifuna indlela yobuchule yokuqinisekisa ukuba ziyahambelana nesimbo sakho sokurhweba kunye neenjongo. Oku kulandelayo ngamanyathelo athile anokukunceda ngokufanelekileyo ukuseta i forex izikhombisi:

2.1. Khetha iSakhelo seXesha esiLungileyo

Ukukhetha ixesha elifanelekileyo lokurhweba sisigqibo esibalulekileyo esihambelana nomntu ngamnye izicwangciso zorhwebo kunye neenjongo. Ixesha elifutshane traders, njenge-scalpers kunye nosuku traders, ngokubanzi ukhetha ukusebenzisa izakhelo zexesha elisezantsi njenge 1-umzuzu ukuya kwi-15-umzuzu iitshathi ukwenza imali ngokukhawuleza, iintshukumo ezincinci. Kwelinye icala, jingi traders kunye nesikhundla traders badla ngokungqiyama ngaku yonke imihla, ngeveki, okanye ngenyanga iitshathi, ukufuna iindlela ezinkulu kunye neentshukumo ezibanzi zeemarike.

Makhe sijonge le tshathi kwisikhokelo esibanzi kwixesha lesakhelo:

| Ixesha elibekiwe | Efanelekileyo | Ixesha lokubamba eliqhelekileyo |

| 1-Umzuzu ukuya kwi-15-Umzuzu | Scalpers / Usuku Traders | Imizuzu embalwa ukuya kwiiyure ezininzi |

| 1-Iyure ukuya kwi-4-Iyure | Intraday Traders | Iiyure ezininzi ukuya ngosuku |

| Yonke imihla ukuya kwiVeki | Ukuguquka Traders | Iintsuku ezininzi ukuya kwiiveki |

| Ngeveki ukuya kwiNyanga | indawo Traders | Iiveki ezininzi ukuya kwiinyanga |

2.2. Lungiselela iiParamitha zeSalathisi

Ukwenza ngokwezifiso forex iiparameters zesalathisi zibandakanya ukulungelelanisa izicwangciso ezingagqibekanga ukuze zihambelane nezicwangciso ezithile zokurhweba, iimeko zemarike, kunye neentlawulo zemali. Ukuphuculwa kwezi parameters kunokukhokelela kwiimpawu ezichanekileyo, eyona nto ibalulekileyo kurhwebo oluyimpumelelo.

Moving ezomhlaba, umzekelo, inokwenziwa ngokutshintsha ubude bexesha. A ixesha elifutshane yenza i-avareji ehambayo ivakale ngakumbi kutshintsho lwamaxabiso, ivelise imiqondiso ekhawulezayo. Ngokuchaseneyo, a ixesha elide ibonelela ngomgca osulungekileyo ongafanelwanga kukuguquguquka, unika umbono ocacileyo wentsingiselo esisiseko.

RSI useto lunokuguqulwa ukuze lutshintshe ubuntununtunu besalathisi. Ummiselo osemgangathweni ngu Amaxesha angama-14, kodwa ukunciphisa eli nani kuya kwenza i-RSI iphendule ngakumbi, enokuba luncedo kwimarike eguquguqukayo. Nangona kunjalo, oku kwandisa amathuba okuba nemiqondiso yobuxoki. Ukwandisa ixesha lokubala kuya kugudisa ijika le-RSI, okunokuthi kubonelele ngemiqondiso ethembekileyo kodwa ngempendulo ecothayo kwiinguqu zemarike.

MACD iparameters ziquka i-avareji ezimbini ezihambayo kunye nomgca wesignali, ngokuqhelekileyo ibekwe kwi 12, 26, kunye nama-9 amaxesha. TradeI-rs inokuhlengahlengisa ezi setingi kumgca okhawulezayo okanye ocothayo womgca wesignali, onokubonisa utshintsho olukhawulezayo kwimarike.

Itheyibhile engezantsi ichaza iziphumo zokuhlenga-hlengisa iiparamitha zezalathisi eziqhelekileyo:

| Isalathisi | Uhlengahlengiso | isiphumo |

| MA | Ixesha elifutshane | Iimpawu ezibuthathaka ngakumbi, ezikhawulezayo |

| MA | Ixesha elide | Ukuthambekela okubuthathaka, okucacileyo |

| RSI | Ixesha elisezantsi | Iimpawu ezibuthathaka ngakumbi, ezingeyonyani |

| RSI | Ixesha eliphezulu | Ubuthathaka obuncinci, iimpawu zobuxoki ezimbalwa |

| MACD | Amaxesha ahlukeneyo | Ii-crossovers ezikhawulezayo okanye ezicothayo |

2.3. Dibanisa iZalathi zokuHlalutya okuPhuculweyo

Ukudibanisa izalathisi kwi a forex isicwangciso sokurhweba sivumela uhlalutyo olunamacandelo amaninzi lweemeko zemarike, ezinokuthi ziphucule izicwangciso zokurhweba ngokubonelela ngokuqinisekiswa kunye nokunciphisa amathuba okuba nezibonakaliso zobuxoki.

Umzekelo, a Ixesha le-50 EMA ingasetyenziselwa ukumisela umkhombandlela wentsingiselo iyonke, ngelixa i RSI inokuqeshwa ukuchonga iindawo zokungena ezinokubakho ngexesha lokutsalwa kwindlela. Xa i-EMA ibonisa i-uptrend, kwaye i-RSI idipha ngaphantsi kwe-30 ngaphambi kokuba ibuyele emva kwayo, oku kungabonakalisa ithuba lokuthenga ngaphakathi komongo we-uptrend enkulu.

Enye indibaniselwano enamandla isebenzisa Bollinger Nyanda ne Oscillator Stochastic. Ngelixa i-Bollinger Bands inceda ukujonga ukuguquguquka kunye nokuchonga iimeko ezigqithisiweyo kunye nezigqithisiweyo, i-Stochastic Oscillator inokubonelela ngesiqinisekiso esongezelelweyo xa umgca wayo wesignali uwela umgca oyintloko phakathi kwezi meko ezigqithiseleyo, ebonisa ukuguqulwa okungenzeka.

Traders rhoqo ukusebenzisa MACD ngokudibene ne ATR ukulinganisa amandla kunye nokulawula umngcipheko. I-MACD ingabonakalisa amandla kunye nesikhokelo somkhwa, ngelixa i-ATR inika ingqiqo malunga nokuguquguquka kwangoku, okuyimfuneko ekumiseni ukulahleka okufanelekileyo kokuyeka kunye nokuthatha inzuzo.

Forex Iintlanganisela zesalathisi:

| Trend Isalathisi | I-Oscillator | Injongo yokudibanisa |

| EMA (50-ixesha) | I-RSI (14-ixesha) | Qinisekisa ukuqhubeka kwendlela kunye neendawo zokungena ezinokubakho |

| Iibhendi zeBollinger (20-ixesha, 2 SD) | Oscillator Stochastic | Chonga ukuguquguquka kunye nokuguqulwa okunokwenzeka |

| MACD (12, 26, 9) | ATR (14-ixesha) | Vavanya amandla kunye nokulawula trade ingozi |

3. IiOscillators zidlala yeyiphi indima Forex Ukurhweba?

Ii-Oscillators dlala a indima ebalulekileyo in forex ukurhweba ngokunceda ekuchongeni iimeko ezithengwe ngokugqithisileyo nezithengiswe ngokugqithisileyo, isantya semalike yegeyiji, kunye nokuqinisekisa uguqulo okanye ukuqhubeka. Ziluncedo kakhulu kwi iimarike ezijikelezayo okanye ezisecaleni, apho izalathisi ezilandela umkhondo ezifana nemiyinge ehambayo zingqineka zingasebenzi kakuhle.

Oscillator Stochastic:

- Ilinganisa ixabiso langoku ngokunxulumene noluhlu lwamaxabiso kwixesha elithile.

- Yenza ithengwe kakhulu (>80) kwaye ithengiswe kakhulu (<20) iimpawu.

- Ingabonisa amanqaku anokubakho okubuyisela umva xa umgca we-%K unqumla umgca we-%D.

I-Index of Strength Index (RSI):

- I-Oscillates phakathi kwe-0 ukuya kwi-100, ngokuqhelekileyo isebenzisa isethingi yexesha eli-14.

- Iimilinganiselo ngaphezulu kwe-70 cebisa iimeko ezithengwe ngokugqithisileyo, ngelixa ngezantsi kwe-30 bonisa ukuba ithengiswe ngaphezulu.

- Ukwahluka phakathi kwe-RSI kunye nesenzo sexabiso kunokubonisa utshintsho oluzayo.

Ukuhambisa umndilili wokuDibana kokuDibana (MACD):

- Iqukethe imilinganiselo emibini ehambayo (umgca we-MACD kunye nomgca wesignali) kunye ne-histogram.

- Traders khangela ii-crossovers phakathi komgca we-MACD kunye nomgca wesignali ukuchonga amathuba okuthenga okanye ukuthengisa.

- I-histogram ibonisa umgama phakathi komgca we-MACD kunye nomgca wesignali, ebonisa amandla okukhawuleza.

Iimpawu zeOscillator:

| I-Oscillator | iNqanaba lokuThengiswa ngokugqithisileyo | iNqanaba eliThengisiweyo | Usetyenziso oluphambili |

| Stochastic | Ngaphezulu kwe 80 | Ngezantsi kwe20 | Imiqondiso yokubuyisela umva |

| RSI | Ngaphezulu kwe 70 | Ngezantsi kwe30 | Market Extremes |

| MACD | I-Crossover Ngaphezulu kwe-0 | Crossover Ngezantsi kwe0 | Umzila kunye neMomentum |

Ii-oscillators zixabiseke kakhulu xa zidityanisiwe nezinye uhlalutyo yobugcisa izixhobo, ukunika a umbono opheleleyo yemarike. Umzekelo, umqondiso othengisiweyo ogqithisiweyo ovela kwi-RSI ngexesha lokunyuka okuchongiweyo ngumndilili ohambahambayo unokubonwa njengethuba lokuthenga, njengoko icebisa ukutsalwa okwethutyana endaweni yokubuyela umva.

I-Oscillator kunye neNdibaniselwano yesalathisi esiTrendi:

| Trend Isalathisi | I-Oscillator | Imeko efanelekileyo | Trade inyathelo |

| EMA (50-ixesha) | I-RSI (14-ixesha) | I-RSI ithengiswa kakhulu kwi-Uptrend | Cinga Ngesikhundla Eside |

| SMA (200-ixesha) | Stochastic | I-Stochastic Overbought kwi-Downtrend | Cinga Ngesikhundla Esifutshane |

4. Yintoni omawuyiqwalasele xa ukhetha Forex Iimpawu?

Ukukhetha ilungelo forex izikhombisi zifuna uhlalutyo olubanzi lwezinto ezahlukeneyo zokuqinisekisa ukuba zihambelana nesicwangciso sakho sokurhweba kunye neemeko zemarike. Nalu uluhlu lweengqwalasela ezibalulekileyo:

UkuHlola ukuPhendula kweSalathisi vs. Lag

- Ukuphendula: Izalathisi ezifana ne Oscillator Stochastic kwaye RSI sabela ngokukhawuleza kwiinguqu zexabiso, ukubonelela ngemiqondiso ngexesha elifanelekileyo.

- team: Izalathisi ezifana nee-avareji ezihambayo zinokulibazisa imiqondiso kodwa zinikezele ngenzuzo yokugudisa ingxolo yexabiso.

Ulawulo loMngcipheko kunye neZalathi zokuguquguquka

- Umyinge woLungiso lwenyani (ATR): Imilinganiselo okungazinzi kweemalike kwaye inceda ekumiseleni amanqanaba afanelekileyo okuyeka ukulahlekelwa.

- Bollinger Nyanda: Nikeza ulwazi malunga nokuguquguquka kweemarike kunye namanqanaba exabiso ngokunxulumene nokutenxa okusemgangathweni.

Unxulumano neZigaba zeMarike kunye neeKlasi ze-Asethi

- utyekelo: Izalathisi ezifana ne-MACD kunye nee-avareji ezihambayo zisebenza kakuhle kwiimarike ezihamba phambili kodwa zinokuvelisa imiqondiso yobuxoki kuluhlu.

- uluhlu: Ii-Oscillators ezifana ne-RSI kunye ne-Stochastic zikhethwa kwiimarike zoluhlu ukuze zibone iimeko ezithengisiweyo kunye neemeko ezithengiswa kakhulu.

| Uhlobo lwesalathisi | Imeko yeMarike | Iimpawu ezikhethwayo | Injongo |

| Umzila-Ukulandela | IiMarike ezihamba phambili | MACD, iAvareji ehambayo | Chonga icala kunye namandla omzila |

| Ii-Oscillators | Iimarike eziBond | RSI, Stochastic | Khangela amanqanaba athengwe kakhulu/athengiswe kakhulu |

Ukwenziwa ngokwezifiso kunye nokuqwalaselwa kweXesha leXesha

- Ukurhweba ixesha elifutshane: Sebenzisa izikhombisi ezinamaxesha amafutshane kwimiqondiso ekhawulezayo.

- Ukurhweba ixesha elide: Khetha izikhombisi ezinamaxesha amade kwiintsingiselo ezibalulekileyo.

Ukuhambelana kwesalathisi kunye noQinisekiso

- Dibanisa izalathi ezihambelanayo ukuze uqinisekise imiqondiso.

- Kuphephe ukusebenzisa izikhombisi ezibonelela ngolwazi olungafunekiyo.

Ukubuyisela umva kunye neSicelo sokwenyani seHlabathi

- Emuva izalathisi zokuvavanya ukusebenza kwazo zonke iimeko zeemarike ezahlukeneyo.

- Faka izikhombisi kwi-akhawunti yedemo ukulinganisa usetyenziso lwehlabathi lokwenyani.

Indibaniselwano yoLawulo loMngcipheko

- Dibanisa izikhombisi kwisikhokelo solawulo lomngcipheko olubanzi.

- Qinisekisa ukuba iimpawu zezalathisi azikhokeleli ekutyhilekeni ngokugqithisileyo okanye ekuthatheni umngcipheko ngokugqithisileyo.