1. Yintoni iRibhoni eMoving Average?

A avareji Ukuhambisa iRibhoni yi uhlalutyo yobugcisa isixhobo siqulunqwe ngemiyinge emininzi ehambayo yobude obahlukeneyo obucwangciswe kwitshati enye. Le ndlela yokubonisa ibonisa uluhlu lwemigca eyenza imbonakalo efana neribhoni, leyo traders sebenzisa ukuchonga zombini umkhomba ndlela kunye namandla.

Iribhoni iqulathe imiyinge ehambayo edla ngokubalwa kwixesha elifutshane, eliphakathi, kunye nexesha elide. Ezi zinokusuka kwi-avareji yexesha elifutshane kakhulu njengeentsuku ezi-5 ukuya kwi-avareji yexesha elide njengeentsuku ezingama-200. Xa i-avareji yokuhamba kwexesha elifutshane ingaphezulu kwemiyinge yexesha elide, icebisa ukuba phezulu. Ngokuchaseneyo, xa imiyinge yexesha elifutshane ingaphantsi, ibonisa a downtrend.

Trader qwalasela ukwahlukana okanye ukuhlangana kwemigca ngaphakathi kweribhoni. A iribhoni ebanzi kuthetha indlela eyomeleleyo, ngelixa a iribhoni emxinwa okanye leyo iqala ukuthungelana icebisa umkhwa obuthathaka okanye ujiko olunokwenzeka. IRibhoni ye-Avareji ye-Moving ingenziwa ngokwezifiso ngokukhetha amaxesha ahlukeneyo kunye neentlobo zemiyinge ehambayo, efana nelula, i-exponential, okanye i-weighted, ukuze ihambelane nezicwangciso ezahlukeneyo zokurhweba.

IRibhoni ye-Avareji ye-Avareji ayikho nje isalathisi esilandelayo; inokubonelela ngenkxaso eguquguqukayo kunye namanqanaba okumelana. TradeI-rs inokukhangela unxibelelwano lwamaxabiso kunye nemigca yeribhoni ukwenza izigqibo ezinolwazi malunga neendawo zokungena kunye nokuphuma, kunye nokuseta. stop-ilahleko iiodolo.

2. Indlela yokuSeta iQhinga eli-Avareji leRibhoni eliHambayo?

Ukukhetha i-Avareji ehamba ekunene

Ukumisela iqhinga leRibhoni eliHambisayo liqala ngokukhetha i-avareji efanelekileyo ehambayo ukubandakanya kwiribhoni. Ukhetho kufuneka lubandakanye uluhlu lwamaxesha amiselweyo abonisa i trader isimbo sokurhweba esikhethekileyo kunye nexesha lexesha labo trades. Indlela eqhelekileyo kukusebenzisa ulandelelwano lweeavareji ezihambayo kumaxesha anyukayo, anje nge-5, 10, 20, 30, 40, 50, kunye nama-60 amaxesha. Imiyinge ehamba phambili ehamba phambili (EMAs) zidla ngokukhethwa ngaphezu kwee-avareji ezilula ezihambayo (SMAs) njengoko zinika ubunzima obuninzi kwisenzo samaxabiso samva nje kwaye zinokusabela ngokukhawuleza kwiinguqu zexabiso.

Ukuqwalasela iTshati

Nje ukuba imiyinge ehambayo ikhethiwe, inyathelo elilandelayo kukusebenzisa ezi kwitshathi yexabiso. Uninzi lwamaqonga okurhweba anokongeza imiyinge emininzi ehambayo kunye nokwenza ngokwezifiso iiparamitha zabo. Qinisekisa ukuba umndilili ngamnye oshukumayo usetelwe kuhlobo oluchanekileyo (olulula, olucacileyo, okanye olulinganisiweyo) kunye nexesha. Kukwaluncedo ukwabela imibala eyahlukeneyo kumndilili ngamnye oshukumayo ukuze kucace.

Utoliko lweRibhoni

Emva kokuba kusetyenziswe imilinganiselo ehambayo, i-ribbon iya kubumba. Traders kufuneka ibeke esweni uqhelaniso kunye nolandelelwano lwee-avareji ezihambayo. Ye uphawu lwe-bullish, i-avareji emfutshane ehambayo kufuneka ibe phezulu kwiribhoni, kunye neyona mide kakhulu ezantsi, kwaye imigca kufuneka ihambelane okanye ikhuphe ngaphandle. Ye Umqondiso we-bearish, umlinganiselo omde ohambayo kufuneka ube phezulu kunye neyona mfutshane ezantsi, kwakhona kunye nemigca ehambelanayo okanye i-fanning ngaphakathi.

Ukungena kunye namanqaku okuphuma

Amanqaku okungena achongiwe xa ixabiso lihamba ngaphezulu okanye ngaphantsi kweribhoni, okanye xa imilinganiselo ehambayo ihambelana ngendlela ebonisa ukuqala kwendlela. Amanqaku okuphuma okanye ii-odolo zelahleko zokuyeka zingasetwa malunga namanqanaba eribhoni, ngakumbi ukuba ixabiso liqala ukwaphula imiyinge eshukumayo kwicala elichasene nomkhwa okhoyo.

| imeko | inyathelo |

|---|---|

| Ixabiso lihamba ngaphezu kweribhoni | Cinga ngesikhundla eside |

| Ixabiso lihamba ngaphantsi kweribhoni | Cinga ngesithuba esifutshane |

| Ukuhambisa i-avareji yefeni ngaphandle | Amandla etrend ayakhula |

| Imindilili ehambayo iyadibana | Utshintsho olunokwenzeka |

Ukulandela ezi zikhokelo, traders inokuseta ngokusebenzayo kwaye isebenzise iqhinga leRibhoni eMovingyo. Njengazo zonke izicwangciso zokurhweba, ukudibanisa iRibhoni ye-Moving Average kunye nezinye izibonakaliso kunye neendlela zokuhlalutya kubalulekile ukuqinisekisa iimpawu kunye nokulawula. ingozi.

2.1. Ukukhetha iMiyinge yokuHamba eLungileyo

Ukulungelelaniswa neeMeko zeMarike

Ukusebenza kweRibhoni ye-Moving Average kuxhomekeke kakhulu ekukhetheni i-avareji ehambelana neemeko zemarike zangoku. Imarike eguquguqukayo ephawulwa kukuguquguquka okukhawulezileyo kwamaxabiso, kusenokufuna imiyinge emifutshane ehambayo ukuze ibambe umongo wendlela. Ngakolunye uhlangothi, i-avareji ehamba ixesha elide inokubonelela ngomfanekiso ocacileyo kwimarike ebonisa ukuguquguquka okuncinci kunye neendlela ezibonakalayo ezicacileyo, ukuhluza ingxolo kunye nokuguquguquka kwexesha elifutshane.

Ukuziqhelanisa neSimbo sokuRhweba

The tradeisitayile somntu ngamnye sichaphazela kakhulu ukhetho lwemiyinge ehambayo. Usuku traders Isenokungqiyama ngakwiribhoni equlethwe yimiyinge eshukumayo yexesha elifutshane kakhulu, enje ngo-5, 10, kunye namaxesha ali-15, ukubona utshintsho olukhawulezayo. Ukuguquka traders, ejonge ukubamba iintsingiselo kwiintsuku ezininzi okanye iiveki, inokukhetha umxube oquka i-avareji ukusuka kwi-30 ukuya kwi-60 yamaxesha. indawo traders, kunye nombono wexesha elide, unokufumana ixabiso ekufakeni i-avareji ehambayo ukusuka kwi-100 ukuya kwii-200 zamaxesha ukuze kuqinisekiswe ukunyamezela kwesiqhelo ngokuhamba kwexesha.

Ukuqwalaselwa kweXabiso lokuSebenza

Uvakalelo lwemiyinge ehambayo ukuya kwiintshukumo zamaxabiso yenye into ebalulekileyo. Ii-EMA zinovakalelo ngakumbi ngenxa yojoliso lwazo kumaxabiso akutshanje, zibenza bafaneleke traders abafuna izalathisi ezikhawulezayo. Nangona kunjalo, obu buntununtunu bunokukhokelela kwiimpawu zobuxoki kwiimarike ze-choppy. Ngokuchaseneyo, Ii-SMAs bonelela ngeseti yedatha egudisiweyo, enokuba yintengisovantageous for traders ukufuna ukuphepha ukuqhambuka kobuxoki.

I-Synergy kunye nezixhobo zeMarike

Izixhobo zemali ezahlukeneyo zinokuphendula ngcono kumaxesha athile. Iperi yemali ephezulu utywala, njengaye YeEUR / USD, inokulandelela kakuhle ngemiyinge emifutshane ehambayo. Kwangaxeshanye, a yorhwebo kunye neendlela zamaxesha onyaka, ezifana ne-oyile ekrwada, zinokulungelelaniswa ngcono nexesha elide. Traders kufuneka umva iavareji zabo ezikhethiweyo ngokuchasene nedatha yembali yentengiso yabo ethile ukuze bacokise ukhetho lwabo.

Ngokukhetha ngononophelo imiyinge ehambayo ehambelana nokutshintsha kweemarike, isitayile sokurhweba, ubuntununtunu bexabiso, kunye nokuziphatha kwesixhobo semali esikhethiweyo, traders inokomeleza ukusebenza kweqhinga labo leRibhoni eMoving Average. Kubalulekile ukukhumbula ukuba akukho ndibaniselwano enye yee-avareji ezihambayo ziya kuba ziphezulu jikelele; ukuvavanya okuqhubekayo kunye nokulungelelaniswa kubaluleke kakhulu ekugcineni ukufaneleka kwesi sixhobo sohlalutyo lobugcisa.

2.2. Ukwenza ngokwezifiso i-Avareji ezihambayo kwi-TradingView

Ukwenza ngokwezifiso i-Avareji ezihambayo kwi-TradingView

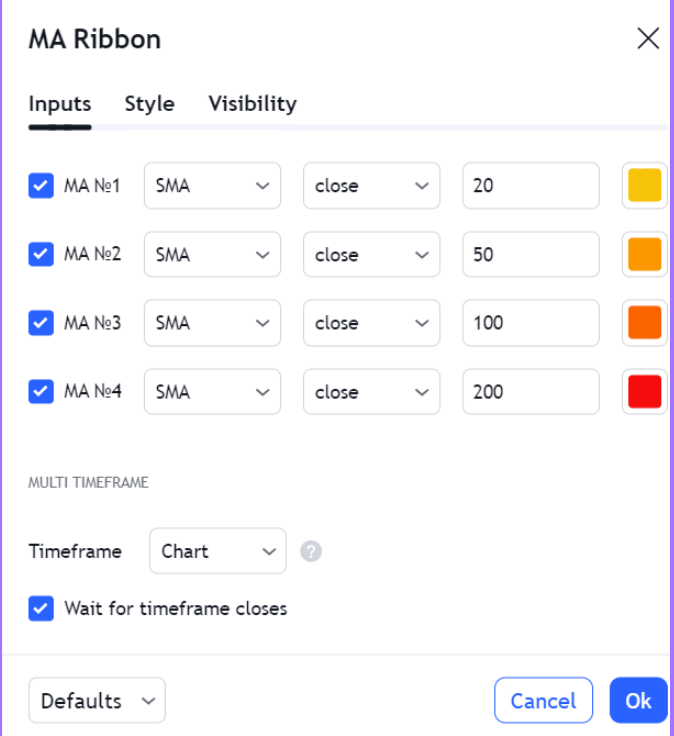

I-TradingView inikezela ngeqonga eliqinileyo traders ifuna ukuqesha iqhinga leRibhoni eMovingyo kunye nomsebenzisi-friendly interface yokwenza ngokwezifiso imiyinge ehambayo. Ukuqala, fikelela kwi Izalathisi imenyu kwaye ukhethe avareji Ukuhambisa amaxesha amaninzi ukongeza ubude obahlukeneyo. Umzekelo ngamnye unokuhlengahlengiswa ngamnye ngokucofa iisetingi cog ecaleni kwegama lesibonisi kwitshathi.

Kwi Okungenayo tab, khankanya ixesha lomndilili ngamnye oshukumayo, uqinisekise ukuba ulandelelwano lubonisa i trader ixesha elikhethiweyo elikhethiweyo. I isimbo ithebhu ivumela ukwenziwa ngokwezifiso kombala ngamnye ohambayo kunye nobukhulu, iququzelela ukwahlukana okucacileyo phakathi kwamaxesha ahlukeneyo. Kwiribhoni ephendulayo ngakumbi, traders bangakhetha Ii-EMA ngaphakathi kwe MA Indlela imenyu ehlayo.

Ukwenza ngokwezifiso okuphambili, traders inokusebenzisa iqonga I-Pine Script umhleli ukwenza isalathisi seRibhoni esiPhambili esiBespoke. Olu lwimi lokubhala luvumela ukucaciswa kweeparamitha ezithile kunye neemeko, njengokuthungatha okuzenzekelayo phakathi kwee-avareji ezihambayo ukujonga amandla endlela ngokubonakalayo.

| uphawu | Ukukhetha ngokwezifiso |

|---|---|

| UKhetho lwesalathisi | Yongeza i-avareji ezininzi ezihambayo |

| Iisetingi zeXesha | Chaza ubude be-MA nganye |

| Ukwenziwa Kwesimbo | Lungisa umbala kunye nobukhulu bomgca |

| MA Indlela | Khetha phakathi kwe-SMA, ema, WMA, njl. |

| I-Pine Script | Bhala imibhalo elungiselelwe iimfuno ezizodwa |

Ngokusebenzisa ezi mpawu, traders banokuqwalasela iRibhoni yabo eMoving Average ukuze batshatise indlela yabo yorhwebo ngokuchanekileyo. Kubalulekile ukuphonononga rhoqo kwaye ulungelelanise ezi zicwangciso ukuze ulungelelanise nokutshintsha kweemeko zemarike kunye nokugcina ukusebenza kwesicwangciso.

2.3. Ukulungelelanisa iiSetingi kwi-MetaTrader

Ukulungelelanisa iiSetingi kwi-MetaTrader

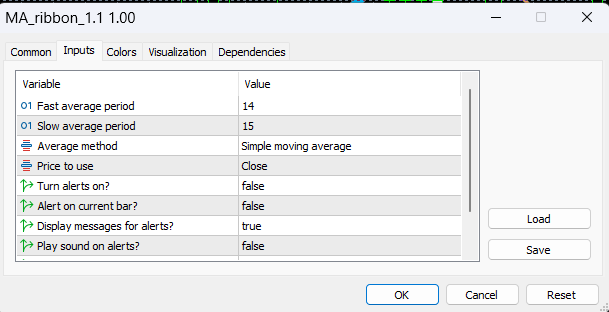

metaTrader, iqonga elisetyenziswa ngokubanzi phakathi traders, ivumela uqwalaselo lweRibhoni eMovingyo ngokulula. Ukulungelelanisa useto, vula i Navigator ifestile kwaye tsala i avareji Ukuhambisa isalathisi kwitshati ngexesha ngalinye elifunekayo. Okulandelayo ukucofa ekunene kumgca ngamnye we-MA nokukhetha Properties ivula ifestile yokwenza ngokusesikweni.

Kule festile, traders inokuguqula i ixesha, ukutshintsha, MA Indlela, yaye Faka isicelo kwi iiparamitha. I MA Indlela inikeza iinketho ezinje ngeSilula, I-Exponential, iSmoothed, kunye neLinear Weighted. Indlela nganye yokuphendula kwisenzo sexabiso iyahluka, nge Exponential ikhethwa kwindlela eguqukayo ngakumbi. I Faka isicelo kwi isethingi inquma ukuba yeyiphi idatha yexabiso-evaliweyo, evulekileyo, ephezulu, ephantsi, ephakathi, eqhelekileyo, okanye enesisindo esisondeleyo-ifakwe kwi-MA calculation.

Umahluko obonakalayo uququzelelwa yi imibala ithebhu, apho imibala ekhethekileyo inokwabelwa umgca ophakathi ohambayo. Ngaphezu koko, i Amanqanaba ithebhu yenza ukongezwa kwemigca ethe tye kumaxabiso achaziweyo, anokusebenza njengabamakishi benkxaso okanye ukuchasana.

Kwabo bafuna inkqubo elungelelanisiweyo, izikhombisi zesiko ziyafumaneka ukukhuphela okanye zinokufakwa ikhowudi ngolwimi lwe-MQL4. Ezi zalathi ziyakwazi ukuqinisa i-ribbon yonke kunye neeparitha ezibekwe ngaphambili, ukunciphisa ixesha lokucwangcisa kunye nokwenzeka kwephutha.

| ye parameter | iinketho | Injongo |

|---|---|---|

| ixesha | Ngokwezifiso | Icwangcisa inani leebar zokubala ze-MA |

| ukutshintsha | Ngokwezifiso | Lungisa i-MA offset ngokunxulumene nebar yangoku |

| MA Indlela | SMA, EMA, SMMA, LWMA | Imisela uhlobo lomndilili ohambahambayo |

| Faka isicelo kwi | Idatha yexabiso eyahlukeneyo | Ikhetha indawo yexabiso yokubala kwe-MA |

| imibala | Ngokwezifiso | Ivumela umahluko obonakalayo phakathi kwemigca ye-MA |

Ngokulungisa kakuhle ezi zicwangciso, iMetaTradeabasebenzisi r banokwenza iRibhoni eMoving Average ukulungelelanisa nezinto abazikhethayo zokurhweba, iimeko zemarike, kunye neempawu zezixhobo abazihlalutyayo. Njengoko iimeko zentengiso ziguquka, ukuphononongwa kwakhona kwamaxesha kunye nohlengahlengiso lwezi parameters kubalulekile ukugcina ukusebenza kwesicwangciso.

3. Isetyenziswa njani iRibhoni eMovingyo kwiQhinga lokuNgena?

Ukuchonga iTrendi uQinisekiso

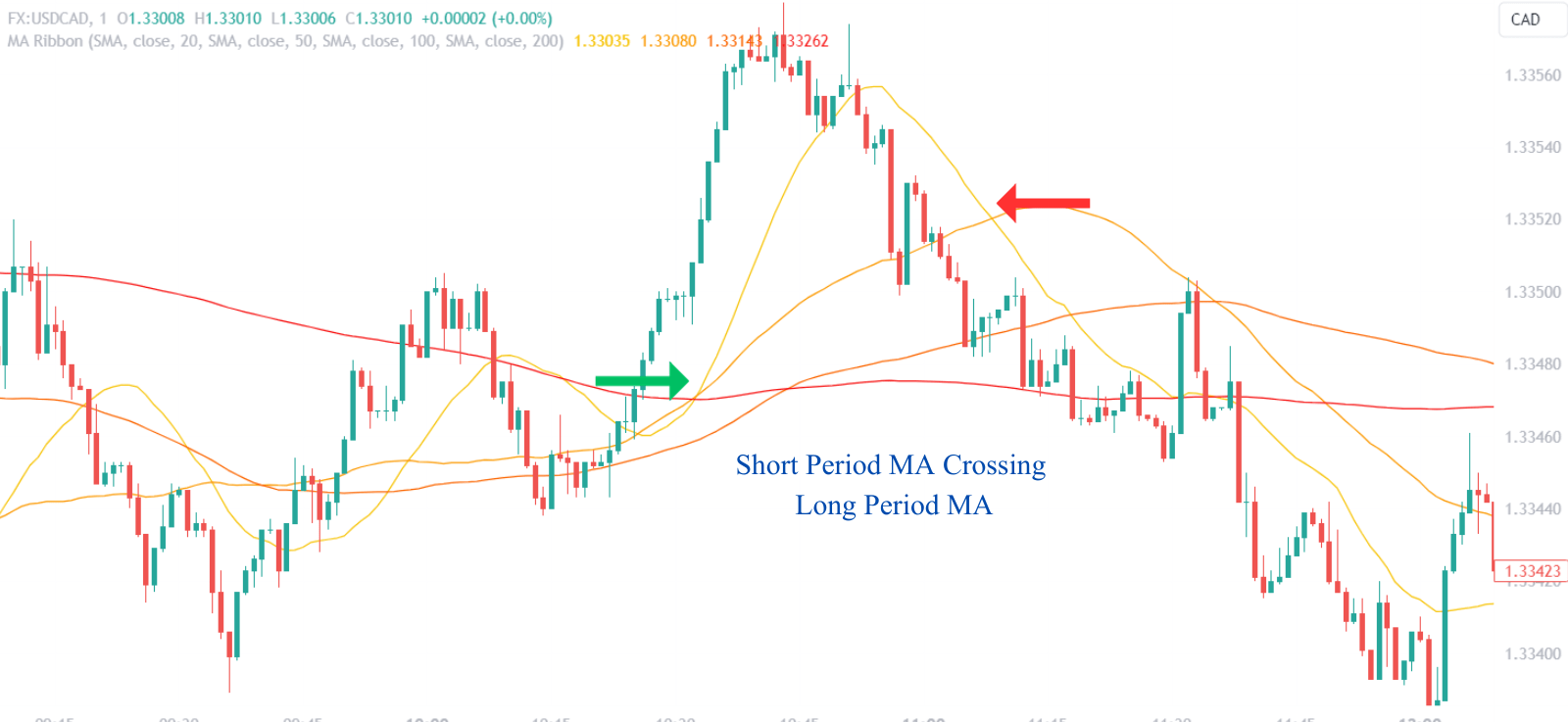

Traders baqeshe iRibhoni eMoving Average ukuze bachonge iindawo zokungena ngokuchonga iziqinisekiso zentsingiselo. An iribhoni enyukayo, apho i-avareji yokuhamba kwexesha elifutshane ibekwe ngaphezu kwexesha elide, izibonakaliso zokunyusa. Ngokuchaseneyo, a iribhoni ehlayo icebisa iimeko ze-bearish. Ukungena kuqwalaselwa xa isenzo sexabiso siqinisekisa isalathiso esibonakaliswe yi-ribbon's orientation.

Umzekelo, a trader usenokungena kwindawo ende xa isenzo sexabiso sivala ngaphezulu kweribhoni, ngakumbi ukuba i imiyinge yokuhamba kwexesha elifutshane kutshanje bawele ngaphezulu kwemiyinge yexesha elide. Le crossover inokubonwa njengobungqina bokunyuka okuphezulu. A i-tight stop-ilahleko isoloko ibekwe nje ngaphantsi kweribhoni okanye owona mndilili wamva nje uhambayo ngaphakathi kweribhoni esebenze njengenkxaso.

Ukusebenzisa Ukwandiswa kweRibhoni

Ukwandiswa kweRibhoni, apho umgama phakathi kwee-avareji ezihambayo uyanda, kubonisa ukonyuka kwamandla entsingiselo. Traders jonga olu lwandiso njengophawu lokungena trades kwicala lendlela. Ukwandiswa okulandela ixesha lokudibanisa okanye i-ribbon intertwining kunokubonelela ngophawu olunamandla lokungena, njengoko lubonisa ukuphuma kwisigqibo ukuya kwindlela entsha.

| Umqathango weRibhoni | Intsingiselo | Intshukumo enokwenzeka |

|---|---|---|

| IRibhoni yokunyuka | Bullish Trend isiqinisekiso | Qalisa Isikhundla Eside |

| IRibhoni eyehlayo | Bearish Trend uQinisekiso | Qalisa Isikhundla Esifutshane |

| Ukwandiswa kweRibhoni | Ukwandiswa koTrendi Amandla | Ngena kuMkhomba ndlela |

Ukusetyenziswa kwexabiso lePullbacks

Ukutsalwa kwexabiso kwiribhoni kunokusebenza njengeendawo zokungena ezicwangcisiweyo, ngakumbi xa i-pullback isenzeka kumthamo ophantsi, ebonisa ukungabikho kokukholelwa ekubuyiselweni kwexabiso. Traders inokufuna ukungena kwindawo xa ixabiso lichukumisa okanye lingene kancinane kwiribhoni kodwa lifumane inkxaso, ebonisa ukuba eyona ndlela iphambili isasebenza.

Ukubeka iliso kwi-Avareji yeCrossovers

I-crossovers ehambisa i-avareji ngaphakathi kweribhoni inikezela ngeendlela zokungena ezongezelelweyo. A okwexeshana elifutshane umndilili wokuwela ngaphezulu komndilili wexesha elide ngaphakathi kweribhoni inokuba yi-bullish entry trigger, ngakumbi ukuba iyenzeka emva kwexesha lokuqiniswa kwexabiso. Ngokuchaseneyo, i-avareji yexesha elifutshane yokuwela ngezantsi ibonisa ukungena okufutshane okunokwenzeka. Ezi ziphambano zibaluleke ngakumbi xa zihamba kunye nomthamo wokurhweba okwandisiweyo, ukwandisa ukuthembeka komqondiso.

Ukusabela kwi-Momentum Shifts

Gqi beleni, traders kufuneka iphendule kutshintsho lwesantya olubonakaliswe sisantya kunye nobume bemiyinge eshukumayo yotshintsho lolungelelwaniso. Ulungelelwaniso olukhawulezayo lwemiyinge emifutshane eshukumayo ukuya phezulu kwiribhoni lunokwandulela iintshukumo zexabiso ezinamandla, ukuqinisekisa ukungena kwangexesha. Ngakolunye uhlangothi, ukucotha kwinguqu yokulungelelanisa okanye ukuguqulwa ngokulandelelana kunokufuna ukulumkisa okanye ukuphononongwa kwakhona kwesicwangciso sokungena.

Enyanisweni, i-Ribbon ye-Moving Average kufuneka isetyenziswe ngokubambisana nezinye izikhombisi kunye neendlela zokuhlalutya ukucoca izibonakaliso kunye nokunciphisa amathuba okungeniswa kobuxoki. Umxholo wemarike kunye nokuguquguquka kufuneka kuthathelwe ingqalelo, njengoko banokuchaphazela kakhulu ukusebenza kweribhoni njengesixhobo sokungena.

3.1. Ukuchonga iTrendi Direction

UVavanyo lweRibhoni yokuqhelaniswa

Ukuqhelaniswa neRibhoni eMoving Average kuluncedo ekumiseleni umkhombandlela okhoyo. Iribhoni apho i-avareji ezihambayo zexesha elifutshane zibekwe ngentla kweyexesha elide lubonisa ukunyuka kwamaxabiso. Eli lungiselelo libonisa ukuba isenzo sexabiso samva nje sinamandla kunokusebenza kwangaphambili, okukhokelela ekuboneni i-bullish.

Ngokuchaseneyo, nini i-avareji ezihamba ixesha elide ziphakama ukuya phezulu kwiribhoni, ibonisa ukongamela kwe-bearish sentiment. Apha, ixabiso liye lawa, okanye ubuncinane lisebenza ngaphantsi xa lithelekiswa nomyinge walo wembali, libonisa ukuhla okunokwenzeka.

Ukuphonononga iRibhoni yokuziphatha

Ukuziphatha kweribhoni ekuhambeni kwexesha kunika imikhondo ebalulekileyo malunga nokuzinza kwendlela. A ehambelanayo, iribhoni phezulu-ethambekileyo egcina iileya ezicwangcisiweyo ze-avareji ezihambayo zibonisa ukonyuka okuzinzileyo. Kwelinye icala, a iribhoni ezantsi-ethambekileyo ogcina ulwakhiwo lwayo lukhuselekile lucebisa ukuhla okuzingisileyo.

Ukuhlalutya iRibhoni yokuGuqulela kunye nokuMahluko

Convergence ye-avareji ezihambayo ngaphakathi kweribhoni, apho imigca isondelana kunye, ihlala ilandela umkhwa obuthathaka okanye utshintsho olunokwenzeka kwicala. Okuchasene, ukungafani okanye ukwahlulwa kwemindilili ehambayo yeempawu zokuqina. Iqondo lokwahluka kunokubonelela ngokuqonda kwisantya somkhondo, kunye nomsantsa obanzi ogxininisa intsingiselo eyomeleleyo.

| Uphawu lweRibhoni | Ukubonisa |

|---|---|

| Iodolwe, iphezulu-ithambekile | Ukunyuka okuzinzileyo |

| Iodolwe, ihla-ithambekile | Ukuhla okuzingisileyo |

| Ukudibana kwee-MAs | Umkhwa obuthathaka okanye ukuguqulwa |

| Ukwahluka kwee-MAs | Indlela eyomeleleyo enesantya |

Iribhoni njengeSihluzo esiSetyenziswayo

Iribhoni isebenza njengesihluzi, inceda ukwahlula phakathi kweentsingiselo zokwenyani kunye nengxolo yemarike. TradeI-rs inokungahoyi ukuguquguquka kwexabiso kwexesha elifutshane okungaphazamisi ukuqhelaniswa kweribhoni iyonke, igxile endaweni yoko kwiintshukumo ezizinzileyo eziguqula ubume beribhoni. Le ndlela inceda ekunciphiseni impembelelo yokuguquguquka kunye nokubuyisela okuncinci ekuhlalutyweni kwendlela.

3.2. Amanqaku okungena okubona

UVavanyo lweNdawo engumndilili oshukumayo

Inkalo ebalulekileyo yokubona iindawo zokungena usebenzisa i-Moving Average Ribbon kukuqwalasela ukubekwa kwee-avareji ezihambayo ngokubhekiselele komnye nomnye kunye nesenzo sexabiso. Crossovers ziphawuleka ngokukodwa; ixesha elifutshane lokuwela umyinge wokuwela ngaphezu kwexesha elide lingabonakalisa ixesha elifanelekileyo lokungena kwindawo ende, ngelixa i-inverse scenario ingabonisa ukungena okufutshane. Ukubaluleka kwezi crossovers kunyuswa xa kwenzeka ngomthamo omkhulu, ukubonelela ngesignali yokungena eyomeleleyo.

Ukuqaphela iNxibelelwano yeXabiso kunye neRibhoni

Traders kufuneka banike ingqwalasela enkulu kwindlela amaxabiso adibana ngayo neRibhoni yoMyinge oHambayo. Ixabiso elihlala lihlala kwelinye icala leribhoni ligxininisa isikhokelo sendlela. Indawo yokungena idla ngokuchongwa xa ixabiso, emva kokutsalwa, libamba okanye liphule kancinci iribhoni kodwa lingavali kwelinye icala, libonisa ukuba imeko ekhoyo ingaqhubeka.

Ukusebenzisa Ububanzi beRibhoni ukwenzela ixesha lokuNgena

Ububanzi beRibhoni ye-Moving Average ingaba sisalathisi esinamandla samanqaku okungena kwexesha. Iirebhoni ezimxinwa zicebisa ukuhlanganiswa kunye nokukwazi ukuqhawuka, ngelixa ukwandisa iiribhoni bonisa ukwanda kwesantya somkhwa. Traders inokusebenzisa ukwandiswa njengophawu lokungena trade kwicala lokwandiswa, ulindele ukuba umkhwa unyuke ngesantya.

Ukusebenzisa iVolume njengeSixhobo sokuQinisekisa

Umthamo usebenza njengesixhobo sokuqinisekisa xa ubona iindawo zokungena. Ukunyuka kwevolumu ehamba kunye nokuhamba kwexabiso kwiribhoni okanye i-crossover ngaphakathi kweribhoni yongeza ukukholelwa kwisignali. Ngakolunye uhlangothi, ukuhamba kwexabiso kunye nomthamo ophantsi kunokungabikho ukukholelwa kwaye ngoko kufuna ukuphononongwa ngakumbi ngaphambi kokungena ekungeneni.

Ukubeka iliso kwiiMqondiso zobuxoki

Ukulumkela imiqondiso yobuxoki kubalulekile. Ayilulo lonke unxibelelwano kunye neRibhoni ePhakamileyo eqinisekisa ukungena, ngakumbi kwiimarike ezinqabileyo apho amaxabiso anokuthi rhoqo ukuwela iribhoni ngaphandle kwendlela ezinzileyo. Iimpawu ezongezelelweyo, ezifana ne Relative Index Ukomelela (RSI) okanye Ukuhambisa umndilili wokuDibana kokungafani (MACD), inokusetyenziswa kwi-tandem ukucoca ngaphandle kwemiqondiso ethembekileyo.

| Uhlobo lweMpawu | imeko | Ukuqinisekiswa koMqulu | inyathelo |

|---|---|---|---|

| Ukungena kweCrossover | I-MA emfutshane inqumla ngaphezu kwe-MA ende | Umthamo ophezulu | Cinga ngesikhundla eside |

| Ukungena kweCrossover | Iminqamlezo ye-MA emfutshane ngezantsi kwe-MA ende | Umthamo ophezulu | Cinga ngesithuba esifutshane |

| Intsebenziswano yexabiso | Ixabiso lichukumisa / lingena kwakhona irebhoni | Umthamo ophantsi | Lumka |

| uQinisekiso lweTrendi | Ixabiso lihlala kwicala elinye leribhoni | Umthamo ohambelanayo | Qinisekisa intsingiselo yendlela |

| Ukwandiswa kweRibhoni | I-MAs ikhupha i-fan ebonisa amandla | Ukunyusa umthamo | Ukungena kwexesha kunye nentsingiselo |

Ngokuvavanya ngokucwangcisekileyo le miba, tradeI-rs inokubona iindawo zokungena ngokuzithemba okuphezulu, ngokulungelelanisa abo tradekunye nomfutho wentengiso okhoyo kunye nokunciphisa ukuvezwa kokuqhambuka kobuxoki okanye iintsingiselo ezibuthathaka.

3.3. Ukuqinisekisa ukungena ngeZalathi ezongezelelweyo

Ukusebenzisa i-RSI yoQinisekiso lweNdlela

The I-Index of Strength Index (RSI) yi-oscillator yomzuzu enokuqinisekisa iindawo zokungena ezibonakaliswe yiRibhoni yoMyinge wokuHamba. Ngokuthelekisa ubukhulu beenzuzo zamva nje kwiilahleko zakutsha nje, i-RSI inceda ukuchonga iimeko ezithengiswe kakhulu okanye ezithengisiweyo. Ukufundwa kwe-RSI ngaphezu kwe-70 kubonisa i-market overbought, ngelixa ukufunda ngaphantsi kwe-30 kubonisa i-market oversold market. Xa i-Avareji yeRibhoni iphakamisa ukungena, qinisekisa ngexabiso le-RSI elihambelana nomzila wendlela ngaphandle kokubonisa iimeko ezinzima. Umzekelo, ukungena kwe-bullish kufuneka kuxhaswe yi-RSI engaphezulu komda othengisiweyo, kukhethwa ukuba inyuke ukuya kwindawo ephakathi (50), nto leyo ebonisa ukonyuka kwesantya sokuthengisa.

Ukubandakanya i-MACD yoQinisekiso lokuNgena

The Ukuhambisa umndilili wokuDibana kokuDibana (MACD) sesinye isixhobo esincedisana neRibhoni eMoving Average. Iquka i-avareji ezimbini ezihambayo (ozikhawulezayo kunye nocothayo) kunye ne-histogram elinganisa umgama phakathi kwabo. Umqondiso we-bullish uqiniswa xa umgca we-MACD (i-MA okhawulezayo) uwela ngaphezu komgca wesignali (i-MA epholileyo), ngokukodwa ukuba le ngqungquthela yenzeke ngaphezu kwesiseko se-histogram, ebonisa ukukhawuleza okulungileyo. Ngokwahlukileyo, kwiimpawu ze-bearish, umgca we-MACD owela ngaphantsi komgca wesignali ngelixa i-histogram imivalo yehla ngaphantsi kwesiseko iqinisa ukuqinisekiswa kwe-downtrend.

Ukufaka iibhendi zeBollinger kwiMarike yokuVolatility Insights

Bollinger uZintya ukunika ingqiqo kwi okungazinzi kweemalike kunye namanqanaba exabiso ngokunxulumene nemiyinge ehambayo. Iibhendi ziba banzi ngexesha lokuguquguquka okuphezulu kunye nekhontrakthi ngexesha lokuguquguquka okuphantsi. Ukuphulwa kwexabiso ngaphezu kwe-Bollinger Band ephezulu kunokubonisa ukunyuka okunamandla okunyukayo, ngakumbi ukuba i-Ribbon ye-Moving Average ihambelana ne-bullish. Ngokufanayo, ukudipha kwexabiso ngaphantsi kwebhendi esezantsi kunokuqinisekisa ukungena kwe-bearish, ngaphandle kokuba i-ribbon ijoliswe ezantsi. Umgca ophakathi weBollinger Bands, ngokuqhelekileyo a umlinganiselo olula wokuhamba, ikwasebenza njengendawo eyongezelelweyo yereferensi yeempawu zeRibhoni eMoving.

Ukusetyenziswa kweZalathi eziSekwe kuMqulu woQinisekiso

Iimpawu ezisekelwe kumthamo ezifana ne IVolumu ekwi-Balance (OBV) or Ixabiso eliphakathi kweVolume-Weighted (VWAP) inokuqinisekisa imiqondiso esuka kwiRibhoni eMoving Average. I-OBV yongeza ivolumu kwiintsuku eziphakamileyo kwaye iyisuse ngeentsuku ezisezantsi, inikezela ngomlinganiselo okhulayo onokuqinisekisa amandla endlela. I-OBV enyukayo ecaleni kweribhoni enyukayo yomeleza ukungena kwe-bullish. I-VWAP ibonelela ngexabiso le-avareji yevolumu yosuku, isebenza njengebhentshi. Xa amaxabiso engaphezulu kwe-VWAP ngokudibeneyo neribhoni ye-bullish, icebisa ukunyuka okuqinileyo, ukuthanda ukungena okude.

| Isalathisi | uQinisekiso lweTrendi | Imeko efanelekileyo |

|---|---|---|

| RSI | Ilungelelaniswa neRibhoni yoMkhombandlela | Unqanda ufundo lwe-Oversold/Oversold |

| MACD | I-Crossover ixhasa i-Ribbon Signal | I-Histogram iqinisekisa uMkhombandlela weMomentum |

| Bollinger Nyanda | Ikhefu lexabiso lihambelana neRibhoni | Iibhendi ziyangqinelana noVavanyo lokuguquguquka |

| I-OBV | Umthamo weTrendi uhambelana neRibhoni | Umthamo Owongezelelekileyo Ukukhula Ixhasa iTrendi |

| VWAP | Ixabiso elinxulumene ne-VWAP ehambelana neRibhoni | Amaxabiso Aphezulu/Ngezantsi VWAP Qinisekisa iTrend |

Ngokudibanisa ezi zalathi kuhlalutyo, traders inokufumana umbono omacala amaninzi emarike, iphucula ukuthembeka kwamangenelo aqikelelwe kwiRibhoni yoMndilili oMoving. Isalathisi ngasinye songeza umaleko wokuqinisekisa, ukunciphisa umngcipheko weziphumo ezingeyonyani kunye nokwenza izigqibo ezinobuchule ngakumbi.

4. Zeziphi ezona Nkqubo zilungileyo zokuHambisa i-Avareji yeRibhoni yeQhinga?

Lungiselela iisetingi zeXesha kwiiMeko zeMarike

Iindlela ezigqwesileyo zeqhinga leRibhoni eMovingyo zibandakanya ukulungiswa kwexesha leemeko ezithile zemarike. Amaxesha amafutshane angaphendula kwiinguqu zexabiso, enikezela ngemiqondiso ngexesha elifanelekileyo kwiimarike eziguquguqukayo. Ngokuchaseneyo, amaxesha amade anokuthi afaneleke ngakumbi kwiimarike ezihamba phambili ukunqanda ingxolo yentengiso kunye nokuguquguquka kwexesha elifutshane. Traders kufuneka rhoqo umva umva indibaniselwano yamaxesha ahlukeneyo ukumisela useto olululo lwesimbo sabo sorhwebo kunye nokusingqongileyo kwemarike yangoku.

Ulungelelwaniso phakathi kokuphendula kunye nokuthembeka

Ukufezekisa ukulingana phakathi kokuphendula kunye nokuthembeka ngundoqo. Sebenzisa i-avareji eyahlukeneyo ehambayo ukwenza i-ribhoni ebanzi enokuthi ibonise ngokuchanekileyo ukuguqulwa kweemarike ezahlukeneyo. Indlela eqhelekileyo kukubandakanya umxube weendlela ezimfutshane, eziphakathi, kunye nexesha elide ezihambayo. Olu seto luvumela ukuchongwa kweentshukumo zexabiso ezikhawulezayo kunye neentsingiselo ezisele zisekiwe, zibonelela ngembono ecwangcisiweyo kumfutho wemarike.

Faka uHlahlelo oluNgqongileyo oluBonakalayo

Uhlalutyo oluhambelanayo lokubonwayo lubalulekile xa utolika iRibhoni yoMyinge oHambayo. Nika ingqalelo ukwahlula kunye nomyalelo wemiyinge ehambayo. Isakhiwo esicwangcisiweyo, esifana nefenisi ngokuqhelekileyo sibonisa ukuthambekela okucacileyo, ngelixa i-tangled okanye i-converging seti yemigca ingabonisa i-trend elahlekelwa amandla ayo okanye imarike ekuhlanganiseni. Iimpawu ezibonakalayo kufuneka zihlale zivavanywa kumxholo wesenzo samaxabiso samva nje ukuphepha ukutolika ngendlela engeyiyo.

Dibanisa nezinye izalathisi zobuGcisa

Faka ezinye izibonakaliso zobugcisa ukuqinisekisa iimpawu. Nangona i-Ribbon ye-Moving Average sisixhobo esinamandla ngokwaso, sisebenza kakhulu xa sisetyenziswa ngokubambisana nezinye izikhombisi ezifana ne-RSI, MACD, okanye i-Bollinger Bands. Ezi zixhobo zincedisayo zinokunceda ukuqinisekisa amandla okuhamba, ukukhawuleza, kunye nokuguqulwa okunokwenzeka, okukhokelela kwizigqibo zokurhweba ezinolwazi.

Beka iliso kumxholo weMarike kwaye uhlengahlengise ngokufanelekileyo

Soloko uqwalasela imeko yemarike ebanzi. Ukukhutshwa kwedatha yezoqoqosho, iziganeko ze-geopolitical, kunye novakalelo lwemarike banokuchaphazela zonke izenzo zexabiso kunye nokusebenza kweqhinga le-Moving Average Ribbon. Hlala unolwazi malunga neemeko zemarike ngokubanzi kwaye ulungele ukulungisa isicwangciso ngokufanelekileyo. Oku kunokubandakanya ukuqiniswa kwemiyalelo yelahleko yokuyeka phambi kwezibhengezo ezikhulu okanye ukuphononongwa kwakhona komndilili okhethiweyo wamaxesha okuphendula kuguquko lokuguquguquka kweemarike.

Ngokubambelela kwezi zenzo zingcono, tradeI-rs inokuphucula ukusebenza kweqhinga leRibhoni eMoving, enokuthi ikhokelele kwiziphumo zorhwebo ezinempumelelo.

4.1. Iingqwalaselo zesiSakhelo seXesha

Iingqwalaselo zesiSakhelo seXesha

Xa udibanisa i-Moving Average Ribbon kwisicwangciso sokurhweba, ukukhethwa kwezakhelo zexesha kubalulekile. Amaxesha ahlukeneyo anokuchaphazela kakhulu ukutolikwa kweentsingiselo zeemarike kunye neziphumo zezigqibo zokurhweba. Amaxesha amafutshane, njengomzuzu o-1 ukuya kwi-15 yeetshathi zemizuzu, zidla ngokusetyenziswa ngu ngosuku traders abafuna ukubamba ngokukhawuleza, iintshukumo zamaxabiso e-intraday. Ezi trader baxhomekeke kwiribhoni ukuchongwa okukhawulezileyo kunye neendawo zokungena kunye nokuphuma ngokukhawuleza. Nangona kunjalo, oku kuza ingxolo yemarike eyandisiweyo, enokukhokelela kwisantya esiphezulu seempawu zobuxoki.

Amaxesha amade, njengeetshati zeeyure ezi-4, zemihla ngemihla, okanye zeveki, zithandwa kakhulu ujingi kunye nesikhundla traders. Ezi tradeAbakhathali kangako kukuguquguquka kwexesha elifutshane kwaye bagxile ngakumbi ekubambeni iintshukumo ezinkulu zentengiso kwiintsuku, iiveki, okanye iinyanga. Kwezi zakhelo zexesha, iRibhoni ye-Avareji eshukumayo inceda ukuhluza utshintsho oluncinci lwamaxabiso kwaye ibonelele ngembono ecacileyo yentsingiselo ekhoyo. Izakhelo zexesha elide zidla ngokunikezela ngemiqondiso ethembekileyo, njengoko zibonisa utshintsho olubaluleke ngakumbi kwiimvakalelo zentengiso.

| Ixesha elibekiwe | Isimbo sokuRhweba | Iimpawu zeRibhoni | Ukuthembeka koMqondiso |

|---|---|---|---|

| Mfutshane (1-15min) | Trading Day | Ukuchongwa kwendlela ekhawulezayo | Phantsi (ingxolo eninzi) |

| Mde (4H-Mihla) | Ujingi/Isikhundla | Ihluza ukuhla kwexabiso okungephi | Phezulu (ingxolo encinci) |

Kukwabalulekile ukuba traders ukulungelelanisa ixesha kunye nesimbo sabo sorhwebo kunye nokunyamezela umngcipheko. Ukungahambelani kunokubangela ukungonwabi kunye nokungahambi kakuhle trades. Ngokomzekelo, i-risk-averse trader inokufumana ulungelelwaniso oluqhelekileyo olufunwa sisicwangciso sexesha elifutshane sinoxinzelelo kakhulu, ngelixa sisebenza trader bangafumana izakhelo zexesha elide zicotha kakhulu kwaye zingaphenduli kwiimfuno zabo.

Iiparamitha zoMyinge weRibhoni kufuneka zihlengahlengiswe ukuze zihambelane nexesha elikhethiweyo. Amaxesha amafutshane ahambayo zingcono ngokubanzi kwixesha elifutshane lezakhelo, ngelixa ixesha elide zifanelekile ngakumbi kwiizakhelo zexesha elide. Olu lungelelwaniso luqinisekisa ukuba iribhoni ihlala inovelwano kuguquguquko lwentengiso ethile edlalwayo ngexesha elikhethiweyo, iphucula tradeukukwazi ukwenza izigqibo ezinolwazi.

4.2. Iindlela zoLawulo loMngcipheko

Indawo yokubeka indawo

Ubungakanani bendawo bubuchule obusisiseko bolawulo lomngcipheko. Ibandakanya ukumisela isixa-mali esiyinkunzi esiza kwabelwa a trade sekelwe kwi trader ukunyamezela umngcipheko kunye nobungakanani beakhawunti. Indlela eqhelekileyo kukubeka umngcipheko kwipesenti encinci yeakhawunti enye trade, ngokuqhelekileyo phakathi kwe-1% kunye ne-2%. Esi sicwangciso siqinisekisa ukuba uluhlu lwelahleko aluyi kutsala kakhulu i-akhawunti, luvumela trader ukuqhubeka nokusebenza nangexesha lokulahlekelwa.

Misa ii-Orders zokuyeka

Ukuyeka ukulahleka kwee-odolo zibalulekile ekulawuleni ilahleko enokwenzeka. Le miyalelo imiselwe kwinqanaba elimiselweyo kwaye iya kuvala ngokuzenzekelayo isikhundla xa ixabiso lifikelela kuloo ndawo. Kumxholo weRibhoni ye-Moving Average, i-stop-loss inokuthi ibekwe ngaphantsi kwe-avareji ehamba phambili ehamba phambili ngaphakathi kweribhoni okanye phantsi kwe-swing yamva nje ephantsi kwindawo ende. Kwisithuba esifutshane, ilahleko yokuyeka inokubekwa ngaphezulu komndilili oshukumayo ophambili okanye ujingi oluphezulu lwamva nje.

Imiyalelo yokuthatha inzuzo

Zibaluleke ngokulinganayo imiyalelo yokuthatha inzuzo, evala inzuzo ngokuvala isikhundla emva kokuba ixabiso elijoliswe kuyo lifikelelwe. Ukumisela le miyalelo kufuna ukuqonda ukuguquguquka kweemarike kunye nokuhamba kwexabiso eliphakathi. Xa usebenzisa iRibhoni ye-Moving Average, amanqanaba okuthatha inzuzo anokuthi ahambelane namanqanaba okuxhathisa angundoqo kwi-uptrend okanye amanqanaba enkxaso kwi-downtrend.

Ukuyeka ukulandela umkhondo

uyamlandela zokumisa nikezela ngendlela eguquguqukayo yolawulo lomngcipheko. Bahlengahlengisa njengoko ixabiso lihamba ngokuthanda i trade, ukugcina inxalenye yengeniso ukuba imarike iyatshintsha. Ukumisa umkhondo kunokumiselwa njengomgama oqingqiweyo ukusuka kwixabiso lemarike okanye ngokusekelwe kwisalathisi sobugcisa, njengomlinganiselo ohambayo ukusuka kwiribhoni.

ukohlulwa

Gqi beleni, ulwahlulo kuzo zonke iindidi zee-asethi ezahlukeneyo okanye amacandelo emarike anokunciphisa umngcipheko ongekho sesikweni. Ngokungavezi kakhulu kwimarike enye, traders inokunciphisa impembelelo yokuhla kwecandelo elithile. Ukudibanisa iqhinga leRibhoni eliPhambili kunye nokwahlukana kunceda ukulungelelanisa ipotfoliyo, okunokubakho ukugudisa imbuyekezo ekuhambeni kwexesha.

| Indlela yokulawula umngcipheko | Injongo | Ukuphunyezwa kunye neRibhoni yoMndilili wokuHamba |

|---|---|---|

| Indawo yokubeka indawo | Umda wokuvezwa ngokwe trade | Yabela ipesenti encinci ye-akhawunti |

| Misa ii-Orders zokuyeka | Lawula ilahleko enokwenzeka | Seta apha ngezantsi/ngaphezulu kwee-MA eziphambili okanye iindawo zokujingi |

| Imiyalelo yokuthatha inzuzo | Ingeniso ekhuselekileyo | Ukulungelelanisa kunye namanqanaba okumelana / nenkxaso |

| Ukuyeka ukulandela umkhondo | Londoloza inzuzo njengoko ixabiso lihambela phambili | Lungisa ngokusekelwe kutshintsho lwamaxabiso okanye ii-MAs |

| ukohlulwa | Ukunciphisa umngcipheko wecandelo elithile | sasaza trades kwii-asethi ezahlukeneyo |

Ngokusebenzisa ezi ndlela zokulawula umngcipheko, traders inokunceda ukukhusela inkunzi yabo ngelixa besebenzisa iqhinga leRibhoni eMovingyo ukuhambahamba kwiimarike.

4.3. Ukudibanisa nezinye iziCwangciso zokuRhweba

Ukungqinelaniswa neeNdlela zokuSebenza ngeXabiso

Ukudibanisa iRibhoni yoMyinge oHambayo nge amaqhinga amanyathelo entengo inyusa i trader ukukwazi ukubona iindawo zokungena ezikumgangatho ophezulu. Isenzo sexabiso sigxile ekuhlalutyweni kweentshukumo zexabiso elicocekileyo, iipateni, kunye nokwakheka ngaphandle kokuxhomekeka kwizibonakaliso ezongezelelweyo. Xa i-Ribbon ye-Moving Average ibonisa ukungena okunokwenzeka, ukuqinisekiswa ngesenzo sexabiso-njengephethini ye-bullish engulfing okanye ikhefu lenqanaba eliphambili lokuchasana-inokubonelela ngeqondo eliphezulu lokukholelwa. trade.

Intsebenziswano kunye neepateni zeTshati

Iipateni zeetshathi, ezifana intloko namagxa, oonxantathu, or iiflegi, ingadityaniswa neRibhoni ye-Avareji ehambayo. Ezi pateni zihlala zinika umqondiso wokuqhubekeka okanye ukubuyisela umva, kwaye xa zilungelelaniswa nendlela eboniswa yiribhoni, ukuba nokwenzeka kokuphumelela. trade inokunyuka. Umzekelo, ukwakheka kweflegi okwenzeka ngaphezulu kwe-bullish-oriented Moving Average Ribbon kunokomeleza ukubakho kokuphuma phezulu.

Ukudityaniswa koBuchule kunye neFibonacci Retracements

Fibonacci ukubuyela kwakhona zisisixhobo esidumileyo sokuchonga inkxaso enokubakho kunye namanqanaba oxhathiso asekelwe kwiinguqu zangaphambili zemarike. Xa i-ribbon ibonisa i-bullish trend kunye nexabiso libuyela kwinqanaba elibalulekileyo le-Fibonacci, njenge-61.8% yokubuyisela, kwaye ibambe, ukudibanisa kwezi zibonakaliso kunokusebenza njengendawo yokungena eqinile kwisithuba eside. Ngakolunye uhlangothi, kwi-downtrend, ukubuyisela kwinqanaba lokumelana neFibonacci elihambelana nesikhokelo seribhoni kunokuba yinto efanelekileyo yokuqalisa ixesha elifutshane.

Ulungelelaniso kunye ne-Elliott Wave Theory

Imigaqo ye Elliott Wave ithiyori inokulungelelaniswa kunye neRibhoni yoMndilili wokuShukumisa ukulindela ukuqhubeka okanye ukuguqulwa. Ukuba i-ribbon ichaza i-trend eqinile kunye nohlalutyo lwe-Elliott Wave lubonisa ukugqitywa kwe-wave yokulungisa, ukungena ekuqaleni kwe-wave impulse wave ihambelana nesantya esikhoyo, esinokukhokelela kwisiphumo esinenzuzo ngakumbi.

Ukudityaniswa noLwakhiwo lweKhandlela

Gqi beleni, Ukwakheka kwekhandlela ezifana neehamile, iinkwenkwezi ezidubulayo, okanye idoji inokuba namandla xa idityaniswe neribhoni. I-candlestick ye-doji eyenza emphethweni weribhoni ngexesha lokutsalwa kwe-pullback inokubonakalisa ukungazinzi kunye nokuqaliswa kwakhona kwendlela. Xa ezi zibonakaliso zekhandlela zivela kungqamaniso kunye nendlela yeribhoni, zinokusebenza njengesixhobo sokungena okanye ukuphuma. trades.

Ngokudibanisa ngobuchule iRibhoni yeMoving Average kunye nezi zicwangciso zohlukeneyo zokurhweba, traders inokwakha indlela eneenkalo ezininzi ephakamisa amandla eendlela ezininzi zohlalutyo. Olu hlanganiso lunokukhokelela ekuqondeni okuthe chatha kwemarike, kuvumeleke traders ukwenza izigqibo ngokuzithemba nangokuchaneka okukhulu.

5. Yintoni omawuyithathele ingqalelo phambi kokusebenzisa iRibhoni yomndilili oshukumayo?

Ukuvavanya uhlobo lweMarike kunye neeMeko

Ngaphambi kokuphumeza i-Ribbon ye-Moving Average, chonga uhlobo lwemarike-uluhlu okanye oluhamba phambili-njengoko oku kuchaphazela ukusebenza kwesalathisi. Kwi imarike ehamba phambili, i-ribbon inikezela ngemiqondiso ecacileyo kunye nemigangatho yayo ehambayo emininzi inika inkxaso enamandla okanye amanqanaba okumelana. Nangona kunjalo, kwi-a kwimarike eqalayo, i-avareji ehambayo inokuvelisa ii-crossovers ezininzi, ezikhokelela kwiimpawu zobuxoki kunye nokulahlekelwa okunokwenzeka.

Ukwenziwa ngokwezifiso kwamaxesha oMndilili wokuHamba

Ukwenza ngokwezifiso imiyinge ehambayo ngaphakathi kweribhoni kubalulekile ukulungelelanisa iinjongo zorhwebo kunye neempawu ezithile ze-asethi. Iimarike eziguquguqukayo kakhulu inokufuna iavareji ezimfutshane ezishukumayo kwiimpendulo ezikhawulezayo, kanti iimarike eziguquguqukayo kancinci zuza kumaxesha amade ahluza ingxolo. Ukubuyisela umva kunye nohlengahlengiso oluqhubekayo luqinisekisa ukuba amaxesha e-ribbon ahlala ehambelana neemeko zemarike zangoku.

Unxulumano neQhinga loRhwebo

Qinisekisa iRibhoni eMoving Average ihambelana neqhinga lakho lonke lokurhweba. Kuya kufuneka incedise isitayile sakho sokurhweba, ukunyamezela umngcipheko, kunye nokhetho lwexesha. Umzekelo, scalpers kunye nosuku traders inokusebenzisa iribhoni eqinile kwiimpawu zexesha elifutshane, ngelixa ukuguquka traders inokukhetha iribhoni ebanzi yokuqinisekiswa kwexesha elide.

Ukudityaniswa nezinye izixhobo zobuGcisa

Ngelixa iRibhoni ye-Avareji eshukumayo sisixhobo esibanzi, akufuneki isetyenziswe yodwa. Ukudibanisa kunye nezinye izixhobo zokuhlalutya lobugcisa kuphucula ukuchaneka komqondiso. Qinisekisa ukuba ezi zixhobo aziboneleli ngolwazi olungafunekiyo kodwa zibonelela ngeembono ezahlukeneyo, ezinje ngevolumu, umfutho, okanye ukuguquguquka.

Ukwaziswa ngeMisitho yezoQoqosho kunye neZikhupho zeNdaba

Hlala uqaphela iziganeko zezoqoqosho kunye nokukhutshwa kweendaba, njengoko ezi zinokuchaphazela kakhulu iimeko zemarike kunye nokusebenza kwezikhombisi zobugcisa ezifana neRibhoni ye-Moving Average. Ukuhamba kweemarike ngokukhawuleza okubangelwa ziziganeko zeendaba kunokungabonakaliswa ngokuchanekileyo kwisalathisi, esinokukhokelela kwiimpawu ezilahlekisayo. Kuyacetyiswa ukuba ugweme ukurhweba ngexesha lokukhutshwa kweendaba ezinkulu okanye uhlengahlengiso lwesicwangciso sokuphendula ngokunyuka kokuguquguquka.

Ngokuqwalasela ezi zinto, tradeI-rs inokwandisa ukusetyenziswa kweRibhoni ye-Moving Average kwi-arsenal yabo yokurhweba, ukuphucula ukukwazi kwabo ukuhamba ngeendlela ezahlukeneyo zeemarike ngempumelelo.

5.1. Iimeko zeMarike kunye nokuguquguquka

Ukuvavanya ukuguquguquka kunye neRibhoni ye-Avareji ehambayo

I-Volatility idlala indima ebalulekileyo ekusebenzeni kweRibhoni eMoving Average. Ukuguquguquka okuphezulu ihlala ikhokelela ekunabeni okubanzi phakathi kwee-avareji ezihambayo, ezibonisa iintsingiselo ezinamandla kodwa kunye nomngcipheko omkhulu wokuguqulwa ngokukhawuleza. Ngokuchaseneyo, ukungazinzi okuphantsi kunokukhokelela ekunabeni okuncinci kunye nee-crossovers eziphindaphindiweyo, ezibonisa imarike edibanisayo kunye nesantya esincinci.

Traders inokulinganisa ukuguquguquka ngokujonga i Ukwandiswa kunye nokucutheka yeribhoni. Iribhoni eyandisiweyo icebisa ukwanda kokuguquguquka kunye nokubakho kwendlela yokomeleza. Kwelinye icala, ikontrakthi yeribhoni inokubonakalisa ukwehla kokuguquguquka, okuhlala kunxulunyaniswa notshintsho oluzayo lwendlela yentsingiselo okanye ukuya kuluhlu lwemarike.

| Inqanaba lokuguquguquka | Ukusasazwa kweRibhoni | Intsingiselo yeMarike |

|---|---|---|

| phezulu | banzi | Umkhwa owomeleleyo, uMngcipheko oPhezulu |

| low | Nxubile | Ukudibanisa, uMngcipheko ongaphantsi |

Ukuzulazula kwiimarike eziguquguqukayo ngeRibhoni eMovingyo, kuyacetyiswa ukuba uhlengahlengise novelwano kwemiyinge ehambayo. Amaxesha amafutshane angasetyenziswa ukusabela ngokukhawuleza kutshintsho lwamaxabiso, ngelixa ixesha elide linokuthi lithobe isiphumo sokuguquguquka, ukunika umgca wendlela ogudileyo ongafanelwanga newhips.

Ukubandakanya a isalathisi sokuguquguquka, njenge VIX, okanye a isalathisi esisekelwe kwi-volatility, njenge Umndilili woloRhoqo (ATR), inokubonelela ngomxholo owongezelelweyo. Ezi zixhobo zinokunceda ukuqinisekisa ukuba ukuguquguquka kwemarike yangoku kulungelelaniswa kunye neempawu ezivela kwiRibhoni ye-Moving Average, evumela ukungena kunye nokuphuma okungaphezulu.

Ngokubeka iliso ngenkuthalo kunye nokuziqhelanisa nokuguquguquka okukhoyo, tradeI-rs inokucokisa ukusabela kweRibhoni eMoving, iphucula usetyenziso lwayo njengenxalenye yesicwangciso sorhwebo esibanzi.

5.2. Unyino lweRibhoni yoMyinge wokuHamba

Indalo eLaggingyo

IRibhoni ye-Avareji ehambayo, ngokuyilwa, yi isalathisi sokushiyeka. Ngokwemvelo ixhomekeke kwidatha yexabiso elidlulileyo ukuvelisa imigca yayo, oku kuthetha ukuba ibonelela ngembono yembali kwaye ayinakuqikelela ukunyakaza kwexabiso elizayo ngokuchanekileyo. Le lag inokubangela ukulibaziseka ekuveliseni umqondiso, okukhokelela ukungena kade okanye ukuphuma kwiimarike ezihamba ngokukhawuleza.

Ukucaciswa koMqondiso kwiiMarike ezisecaleni

IRibhoni eMoving Average inokuvelisa imiqondiso engaqondakaliyo emacaleni okanye kwiimarike ezahlukeneyo. Ii-avareji ezihambayo zikholisa ukuhlangana kwaye zingqubane rhoqo, nto leyo enokukhokelela kuthotho lweziqalo ezingeyonyani okanye izalathisi zentsingiselo ezilahlekisayo. Oku kunokukhokelela ekunyukeni kweendleko zokurhweba kunye nokunciphisa inzuzo ngenxa ye-whipsaw trades.

Ukuthembela ngokugqithisileyo kunye noKululama

TradeI-rs inokuthembela ngokugqithisileyo kwiRibhoni yoMndilili wokuHamba, ucinga ukuba sisixhobo esisilelayo sohlalutyo lwemarike. Oku kuzithemba ngokugqithiseleyo kunokukhokelela ekubeni uxabiso, apho traders ukutyeshela eminye imiba ebalulekileyo yohlalutyo lobugcisa, ezifana amanyathelo ixabiso or Ivolumu. Akukho salathisi esisodwa kufuneka sisetyenziswe ngokuzimeleyo, kwaye i-ribbon ayikho.

Uvakalelo kwiiMeko zeMarike

Ukulungelelanisa i-Avareji ye-Avareji yeRibhoni yobuntununtunu likrele elintlangothi-mbini. Misela i-avareji ehambayo mfutshane kakhulu, kwaye iribhoni iya kusabela kulo lonke utshintsho oluncinci lwexabiso, ukwandisa umngcipheko imiqondiso yobuxoki. Zibeke zinde kakhulu, kwaye iribhoni inokugudisa iintshukumo ezibalulekileyo zentengiso, zibangele ukusabela okulibazisekileyo kutshintsho lwenyani.

Impembelelo yokuguquguquka

I-Volatility spikes inokuba nefuthe elibi ekusebenzeni kweRibhoni ye-Avareji ye-Moving. Ukuguquguquka okuphezulu kunokukhokelela kwiribhoni eyandisiweyo, enokuthi ibonise intsingiselo eyomeleleyo xa, eneneni, inokuba kukuxhathisa okwethutyana kwimarike. Ngokwahlukileyo, ukuguquguquka okuphantsi kunokubangela ukuba i-ribhoni ivume, okunokuthi kunciphise ukubaluleka kophuhliso lokwenyani.

| Umda | Iziphumo |

|---|---|

| Lagging Isalathisi | Ukungena kade/ukuphuma, amathuba aphoswe |

| Imiqondiso yeMarike esecaleni | Izibonakaliso ezingaqondakaliyo, ukwanda kobuxoki |

| Ukuxhomekeka kakhulu | Ukungahoywa kwezinye izixhobo zokuhlalutya, ukuzithoba |

| Uhlengahlengiso lweSensitivity | Umngcipheko wemiqondiso yobuxoki okanye ukulibaziseka kwentsingiselo |

| Impembelelo yokuguquguquka | Ukutolikwa ngendlela engeyiyo kwamandla okanye ubuthathaka beendlela |

Ukuqonda le mida kubalulekile traders ukunciphisa imingcipheko kunye nokusebenzisa iRibhoni ye-Avareji eshukumayo ngokufanelekileyo ngaphakathi kwesicwangciso sorhwebo esibanzi.

5.3. Ukubaluleka koBacktesting

I-Backtesting: Imfuneko yokuQinisekiswa kweQhinga

Ukubuyisela umva yinxalenye ebalulekileyo yokuphuhlisa kunye nokucokisa izicwangciso zokurhweba. Ngokusebenzisa i Ukuhambisa iRibhoni engumndilili kwidatha yembali, traders inokuvavanya ngokuthe ngqo ukusebenza kwesi sixhobo kuzo zonke iimeko zentengiso ezahlukeneyo. Le nkqubo ivumela ukulungelelaniswa kweeparamitha zeribhoni, ezifana nokukhethwa kwamaxesha aphakathi ahambayo ahambelana kakuhle nesenzo sexabiso le-asethi kunye nokuguquguquka.

Inzuzo ephambili yokubuyisela umva ixhomekeke ekukwazini kwayo ukugqamisa amandla kunye nobuthathaka besicwangciso ngaphandle kokubeka umngcipheko wemali eyiyo. Ngokomzekelo, a trader inokugqiba ukuba iRibhoni ye-Avareji eshukumayo ihlala ibonelela ngemiqondiso yokungena kwangethuba kwiimarike ezihamba phambili okanye ukuba ivelisa izinto ezininzi ezingezizo ezingeyonyani ngexesha lamaxesha oluhlu. Ngokuchonga ezi patheni, traders inokuseta izihluzi ezifanelekileyo kwaye lungisa iindlela zokulawula umngcipheko, njengokubekwa kwe-stop-losss kunye ne-odolo yokuthatha inzuzo, ukuphucula ukusebenza kakuhle kwendlela yabo.

Ngaphezu koko, i-backtesting iyanceda ukuvavanya uxinzelelo phantsi kweemeko ezahlukeneyo zemarike, kubandakanywa iziganeko zokuguquguquka okuphezulu kunye nokuphazamiseka kwemarike okungaqhelekanga. Traders bafumana ulwazi malunga nendlela isicwangciso ebesiya kwenza ngayo ngexesha leentlekele zemarike ezidlulileyo, okubenza bakwazi ukubandakanya amanyathelo okuthintela kwizicwangciso zabo zangoku zorhwebo.

Ngelixa ukubuyisela umva ayisosiqinisekiso sokusebenza kwexesha elizayo ngenxa yokutshintsha rhoqo kweemarike, kusebenza njengenyathelo elibalulekileyo kuphuhliso lweqhinga. Kuyanceda traders ukwakha ukuzithemba kwindlela yabo yokusebenza kwaye ibonelela ngesiseko sophuculo oluqhubekayo. Ukuhlolwa okuthe gqolo, okudityaniswe novavanyo oluya phambili kwimekobume yedemo, kuqinisekisa ukuba isicwangciso sihlala sifanelekile kwaye somelele ngokuchasene nemeko engasemva yembonakalo yemarike eguqukayo.

| Inkalo yoBacktesting | Injongo | Isiphumo |

|---|---|---|

| UPhuculo lweParameter | I-Fine-tune Moving Average Ribbon useto | Ukulungelelaniswa kweqhinga eliphuculweyo kunye neendlela zemarike |

| Uvavanyo lokuSebenza | Ukuvavanya ukusebenza kweqhinga lembali | Uhlengahlengiso olunolwazi kwindlela yokurhweba |

| Ulawulo lwengozi | Uvavanyo lokuphumelela kwamanyathelo okukhusela | Ukuphuculwa kwamaqhinga ogcino lwenkunzi |

| Uvavanyo loxinzelelo | Xelisa ukomelela kweqhinga kwiingxaki | Ukulungiselela iimeko zemarike ezigqithisileyo |

Ngokwamkela ukuxhaswa njengelitye lembombo lophuhliso lwesicwangciso, traders baqinisekisa ukuba ukusebenzisa kwabo iRibhoni eMoving Average akusekelwanga kwiintelekelelo zethiyori kodwa kubungqina obunokumelana novavanyo lwexesha.